Have you ever had a payroll error? Who was the first person you approached in the organization?

We are certain that you have thought about what goes on behind your payment cycle, who is responsible, and how you receive your payment on time.

Or, you must have experienced delayed payments without knowing who was responsible and why this happened.

Payroll cycles are continuous activities that focus on loads of numbers and data. The payment process is time-driven and needs a lot of skills and precision.

Payroll has been a primary responsibility of the human resources department, but smaller organizations depend on their finance team for payroll processing.

The human resources department plays multiple roles in payroll-related processes, such as the ones mentioned below.

- Devising salaries

- Handling salary discrepancies

- Revising salaries

- Bonus payments

- Appraisal-linked finances

- Paid and unpaid leave

- Advance payments

- Final claims settlements

- Employee loans and accurate tax deductions

Although these points can help connect HR and payroll, this domain is vast and complex. So, it is an activity that is dependent on people with the assistance of technology such as payroll software or HR Software. Before we get to the specifics, let us understand what payroll is.

What is Payroll

Payroll refers to the list of employees that receive monetary compensation from companies in the form of salary, bonus, benefits. The tool that is used to process the compensation is called the payroll software.

An employer must prioritize this process as salary payment is vital for all departments and teams in his/her organization.

An important part of payroll is the W 4 form. It contains the tax filing information of all employees and ensures that they comply with rules and regulations.

One of the most vital parts of payroll operations is statutory requirements. These are legal obligations put in place by the central and state governments.

Depending on the industry you are a part of and the size of your company, there are several labour and tax laws that you will have to comply with.

Compliance with the government’s laws can be very beneficial for businesses. It helps in maintaining financial health and in increasing employee satisfaction—timely payment of taxes in an indication of a government-friendly and employee-friendly organization.

The components of payroll include taxable income and tax-exempt factors, allowances, and deductions. Some government deductions include:

- Professional taxes

- Income taxes

- Local taxes

- House rent allowance

- Medicare

- Transport allowance

- Leave travel allowance

Now that we know what payroll and payroll taxes are, now let’s see how payroll and the human resources department are connected.

Technology and Payroll

Payroll is essentially a people and technology-driven process. The core hr factor is people. So, how does technology contribute to the payroll system?

Technology has come to support payroll functions largely. The following are some payroll solutions.

Gone are the days of human mathematical errors and mistakes. Manual payment processing is now a redundant activity, and companies have moved to automated payroll systems.

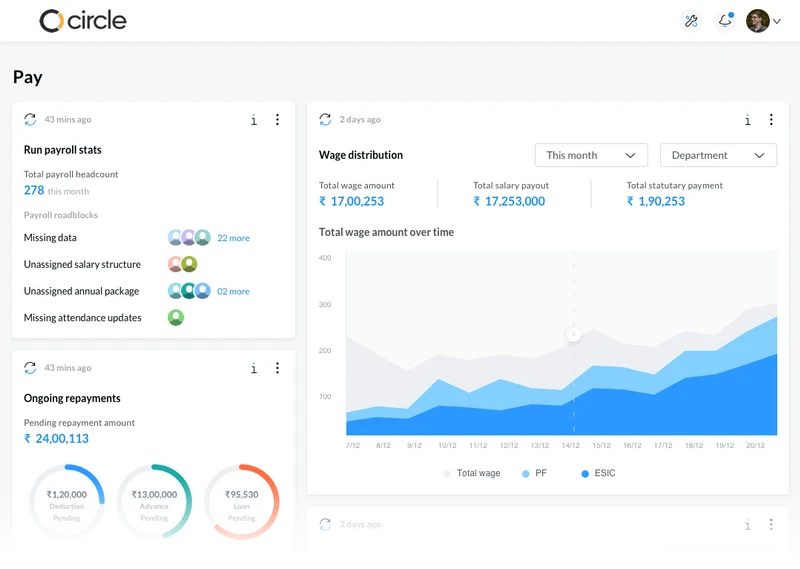

Payroll management software is a convenient medium for mass payment processing. The payroll software ensures time management, easy scheduling, and scalability for organizations.

You will find that payroll software in India is aligned according to the country’s payment norms and local tax obligations. The payroll software can also be aligned and optimized according to the company’s specific needs.

The inputs required for payroll needs to be precise, and hence, this software solution is perfect to handle employee paychecks.

Cloud Technology

Sensitive payroll data can benefit from cloud-based solutions while being transferred from one device to another. There are risks of data leaks, stolen or altered data, or worst-to-case scenarios, even loss of data.

Cloud-integrated payroll software as an adaptation is safe and can integrate with your payroll software or HRMS for better accessibility and risk-free information sharing. So, adapting to cloud-based technology means enhanced data security.

Some payroll service providers are sumHR, GreytHR & Intuit. Intuit comes up with the accounting software Quickbooks, which handles payment programs for small and medium businesses.

Biometric Device

Punch in and Punch out; biometric devices give the flexibility to capture employee time and attendance and gather real-time data for processing payroll. HR Software like sumHR are usually compatible with almost all biometric devices.

GPS Tracker

Now don’t worry about tailing your field staff or faulty claims of client visits. GPS trackers are efficient in helping employers track the time and attendance of field workers.

Data tracking devices provide authentic and real-time data. All it takes is some easy configuration with your system for an integrated HR payroll tracker.

Payroll software is usually a stand-alone product, but if you want a product to manage payroll, track attendance, track performance and more, sumHR is your ideal HRMS Solution.

HR and Payroll

There are many situations in which HR comes to justify and support the payroll activity, as HR has a versatile role to play in the payroll function. They come to define and monitor the payroll system by-.

- Versatile payroll processing capability for permanent, freelance, and temporary employees

- Employment laws and payroll tax adaptations according to location

- Intrinsic calculation based on different parameters and compensation.

- Voluntary deductions and statutory compliances.

Payroll is also dependent on a lot of parameters that the HR department handles every month. Payroll calculation is dependent on a lot of factors, including-

- The structure of employee wages

- Basic compensation and incentives

- Leave and payment structure.

- Hourly rate of payment

- Tax rate and statutory deductions

- Employee loan remittances

- ESIC and PF deductions

- Income tax withholding and claims

- Attendance including paid and unpaid leaves

- Advanced borrowings on the salary.

There are other employee benefits that HR provides for engagement and motivation. These include reward management, reimbursements, bonuses, employee welfare, and managing hike in salaries.

HR also plays a crucial role in designing and defining payroll-related policies like the following.

- Advance payment

- Loan facilitation and repayment

- Maternity and paternity leave and payment structure

- Hourly wage standards for freelancers

- Bonus and other incentive offers

- Extra working hours

- Real-time attendance data and processing

- Office timings, late markings, and payment deduction.

In the event of payment discrepancies, employees know that they have to contact HR and resolve them. The different policies give fair clarity in the payroll calculations.

In addition to all this, with the support of software solutions, HR’s can now generate reports for salary. Any specific salary calculation issue can be traced, and a detailed report can be made available to the employees.

The payroll software is also linked internally to the in-house finance department for payment processing.

Still trying to figure out the relationship between payroll and HR?

Here are some FAQs on payroll services to clear these doubts.

Frequently Asked Questions (F.A.Qs)

What are the necessary inputs that go into the processing of a payment?

Two aspects go into the processing of payment-

- Employee information – Name, designation, attendance record, deductions, advance borrowings, working hours, loan account number, bank account number, PAN number, and more.

- Gathering this data for further processing of the payroll.

Why does HR take care of the payroll function instead of the finance department?

A core HR team manages all the inputs needed for payroll. However, when the payroll is directed through the finance department it usually involves transferring funds transfer which is managed by the finance team as a company’s financials are involved.

What are the risks and controls associated with payroll?

Payroll is susceptible to information linked to employee records, including salary, HRA, loans, ESOPs, incentives, deductions, and other information that the employees may not feel comfortable sharing with others.

There is the risk of this information getting into undesirable hands. The only way to control this is to have a cloud-based HR software like sumHR to handle these inputs.

Who ideally decides the need for automation of payroll in a company?

HR plays a vital role in deciding the adaptation in HRMS as well as payroll. HR is well-versed with the payroll process’s nitty-gritty and are the right people to evaluate the software.

What could be the challenges in payroll, and who can rectify these challenges?

The payroll challenges could be the changing employment norms and laws such as work from home, hourly employees rules, freelance, etc. There could also be changes around the taxation and statutory norms.

These challenges can be rectified and adapted by HR Managers as they know the changing industry and the HR scenario. HR can easily adapt to changes in the company.

How have payroll processes evolved, and what is the role of HR in it?

Payroll processes have been manual and mundane. They need great effort and time in calculations and processing. Human error was a big challenge that the payroll systems faced back then.

Lately, HR Managers have come to streamline payroll processes and save time. HR has also adapted to a structured payroll process by bringing in technology. The scope of any human errors in processing has also been reduced.

Payroll software, biometric systems, GPS trackers, artificial intelligence, and many other technological innovations are used for error-free payroll data processing.

In addition to this, there has been a healthy relationship with payroll and several other software during recent times. Attendance data is collected from Human Capital Management software, while employment data is collected from an HRIS.

Hence, the systems and processes built by HR across various departments, including payrolls, are strong, functional, and reliable.

Why is payroll outsourcing considered risky?

- SMEs seek payroll processing as they either do not have an HR department or are no specialized enough for payroll. An understaffed HR department also leads to the need for outsourcing payroll activity.

- Payroll outsourcing has been considered risky for fear of data breaches and identity theft. Payroll outsourcing makes your sensitivity available to third parties and independent contractors.

- Payroll outsourcing also leads to delays and errors.

- Rectification and gaps in payment is a time-consuming process that leads to more delays.

- Adapting to technology is an important aspect in such cases, as it secures all the above worries and gives you control of your data.

What is the basic need of a payroll function?

Good payroll software can do wonders in saving time and delivering efficiency. As payroll is a time-driven process, the company must employ a dedicated human resource team to process payments, handle gaps, and solve any payment query.

How can start-ups choose the right payroll software?

Start-ups involve systems that still need to be structured. If an HR department is not a part of the system, payroll processing might get trickier. But there are several payroll software in India that are integrated into Indian payroll deductions and compliances.

sumHR brings one such payroll software that offers solutions for small and medium organizations in India. Indian payroll systems are very complicated, and HR software like sumHR bring a payroll solution exclusively for the Indian markets.

Now, you do not need the domain knowledge or experience, as the software is developed to handle your payroll effectively. Be it fixed or flexible payments, tax benefits, declarations, form submissions, cut-out dates, extended allowances, advance payments, loan eligibilities, and a host of other payroll-related services, all these formalities are configured within one software that saves you time and effort.

So what are you waiting for, book a free demo now or start your 7-day free trial to get started?

If you have any questions leave it down in the comments below and I’ll be sure to answer it.