A salary slip is a comprehensive statement of an employee’s pay and deductions for a certain time period. Every month, when an employee receives a salary, the company issues a salary slip to the employee. This salary payslip should typically include the company name, earnings, deductions, employee details like designation, PAN, Bank details, identification code, position in the company, and department the employee is working in. Employees might get a paper copy of this document or it can be mailed to them. They may also see and print salary slips in pdf format. An organization is required by law to give a salary payslip slip to its employees on a regular basis as evidence of wage payments and deductions. Let’s help you with various salary slip formats and a way to download these for free for your usage.

When creating a salary slip, there are a lot of things to keep in mind, salary details such as gross pay, net pay, standard deductions, extra deductions (if applicable), overtime, bonuses, and tips. Furthermore, you must always provide the correct amount against each salary slip section. You have to be mentally prepared to gruel for hours-long corrective struggle if you even miss inserting a zero in the appropriate spot!

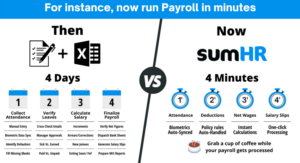

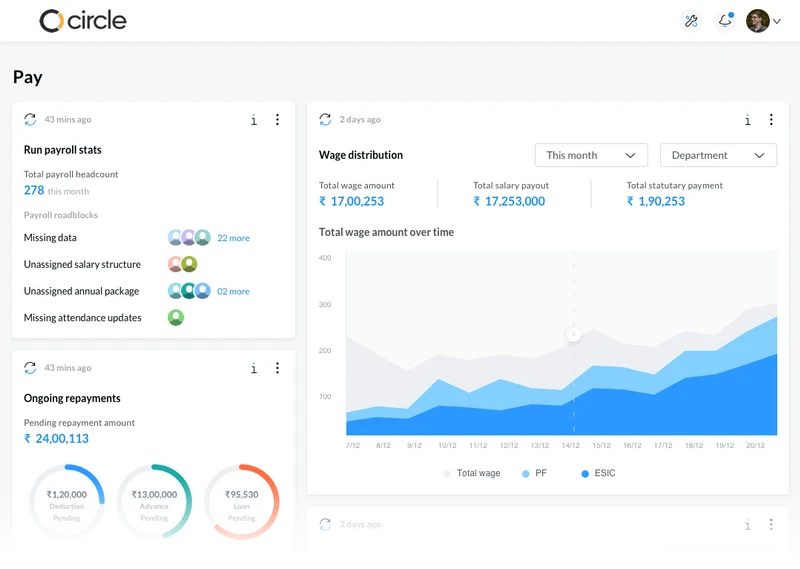

If you are looking for a solution to keep creating salary slips for your employees for free, you can get sumHR – Easy HRMS tool to handle payroll for Free*

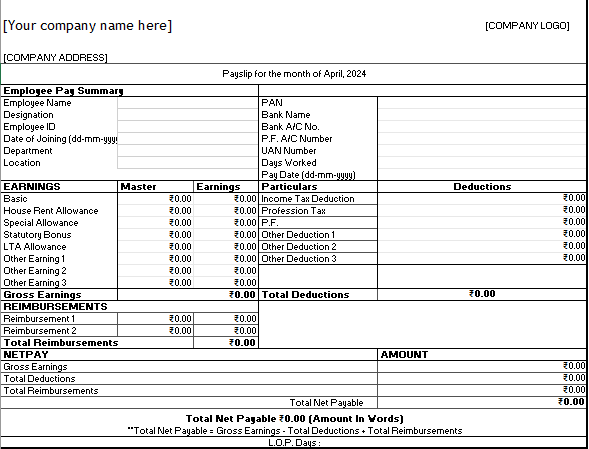

Salary Slip Format In Excel : Free Download

We created a template for easy use. This excel file was created using actual pay slips from different organizations to encapsulate major ‘earnings’ and ‘deductions’ that a company incorporates in their salary sheet. You can download our simple salary slip format in excel by clicking the button below. We have kept the relevant fields for your usage and you can add important formulae for calculations of input fields wherever you deem fit.

Download Salary Slip Format in Excel (Free)

How to make salary sheet in excel?

To make a salary sheet in excel, you need to get a reference file which you can download from above for free. Then you can add/ edit relevant input fields for earnings, deductions, reimbursements, employee details and do all the calculations either manually or by adding relevant formulae. Remember to add L.O.P (Loss of Pay) details if any.

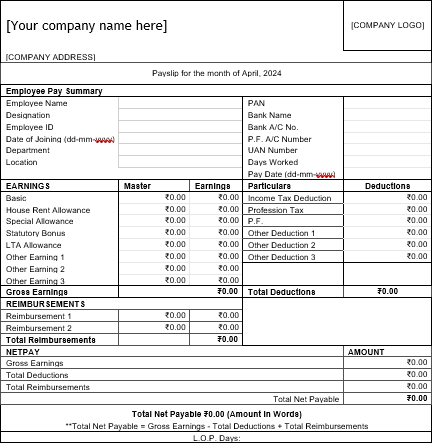

Salary Slip Format In Word : Free Download

This is an exact replica of the payslip excel file that we have created above. We modified the elements a bit so that you can download this simple salary slip format in word. We have ensured that the elements in the template work just fine while printing the final monthly salary slip after you have added all the relevant data.

Download Salary Slip Format in Word (Free)

Salary Slip Format in PDF

We have created a salary pay slip in Excel and Word above, which you can download for free and use to customize as per your requirement. We are adding a PDF file for your reference how a salary slip in general looks like, below.

Are salary slips important?

Salary slips are important for a wide range of reasons. Some of the key advantages of salary slip are mentioned below.

Your salary slip provides evidence of employment

A salary payslip is a legal document that verifies your work status, job title, and monthly income amount. When you apply for a job in a company, apply for a loan, or for an admission to a university or travel visa, you will typically be asked to provide work information, which will be accompanied by your monthly payslips.

Salary slips aid in the preparation of income tax returns

You must obtain the cumulative values for the components like Basic salary, HRA, transportation allowance, medical allowance, leave travel allowance, and other components of salary for the relevant financial year from your salary slips, which are subjected to varied tax treatment. If your firm offers monthly aggregate information, you must do the tax calculation using the last payslip of the year. If you don’t have all of your data on one salary slip, all you have to do is add up the monthly amounts to get the annual totals.

Most allowances enable you to claim a deduction up to the number of your actual costs. The percentage of tax deducted, if any, will also be included on your payslip. If your overall tax burden is below the percentage of tax previously deducted, you may be eligible for a refund.

A salary slip is useful for finding new jobs and salary negotiation

Some companies may request salary slips from your prior employer as confirmation of your current position and salary while you are searching for a new work opportunity. Understanding the various elements of your payslip might assist you in evaluating other job offers. Based on your current job title and income, a salary slip may assist you in negotiating a better position and salary hike with a new company, serving as the foundation for salary discussions. It also acts as income proof and a document of employment.

Salary slip shows your PF contribution

Almost all major corporations are required to deduct a portion of their employees’ income for provident fund contributions. Employers contribute to this fund as well. If you retire or change jobs, you have the option of withdrawing your funds or having them moved to the new employer. This is important because your salary slips provide you with an estimate of how much you contribute each month.

Salary slips are essential in loan and credit card applications

If you apply for a loan or a credit card, the bank or credit card company evaluates your credibility by using your last three to six months’ salary slips. The pay stubs show your monthly net take-home earnings as well as your capacity to achieve your payback commitments. Many banks and financial institutions give salaried customers personal loans and salary advances simply based on their payslips.

Salary Slip Fundamentals

What are Deductions?

An employee is eligible for a tax write-off for professional taxes in the year that the taxes are paid. Unpaid professional taxes are not eligible for compensation reduction.

Starting with the 2019–20 tax year, taxpayers can deduct from their taxable salary the greater of Rs. 50,000 or their actual taxable salary. The assessee’s pension income is also eligible for the Rs. 50,000 deductions. Taxpayers should know they cannot claim a loss under the head ‘Wages’ due to legislation. Deductions will be capped at Rs.50000 if the pay is less than that.

Formulas for calculating Salary

An employee’s basic pay is a foundational component of their compensation, serving as the basis for calculating other benefits such as a pension, gratuity, and so on. Companies often use straightforward methods when determining entry-level pay.

Annual basic salary = Basic Monthly Salary * 12 months

However, there is no universal minimum wage method because the amount varies from business to business and on different levels. A proportion of both the pay and the CTC should be used in the salary calculating method. An individual’s basic pay typically constitutes 40% of their gross income or 50% of their CTC.

You may also use alternative methods to calculate the minimum wage. An alternative, equally straightforward formula is as follows:

Basic salary = Percentage of the CTC or gross pay

CTC vs Gross Salary vs Net Salary

The term “cost to company,” abbreviated CTC, refers to the overall cost of recruiting an employee for a business in accounting and finance. It is the sum that each firm invests in its workers from the perspective of the business.

CTC = Direct Benefits + Indirect Benefits + Savings Contributions

CTC and gross salary are sometimes confused, but there is a distinction between the two. Gross salary is paid to the employee before tax withholding, Employee Provident Fund (EPF) contribution deduction, and gratuity removed from CTC. The gross wage includes direct and indirect benefits, overtime pay, and other differentials.

An employee’s pay in cash or their bank account after tax deductions is their net salary.

Net Salary = CTC – Provident Fund Contribution – Gratuity – Income Tax (TDS)

The standard format of salary slip

The salary slip format mainly has two parts – Income and Deductions. The components of income are basic salary and allowances like house rent, transport, medical, dearness, and other special allowances. The salary components of deductions are the employee provident fund deductions and taxes like professional tax and Tax Deducted At Source (TDS).

Standard components in a salary slip

Salary slips are only important to most individuals when applying for a loan or a credit card. However, it’s critical to have a deeper understanding of the salary slip structure. The right understanding helps you utilize all available deductions to reduce your tax obligation and determine what portion of your paycheck is set aside for mandatory savings like EPF, ESI, etc.

Here is the detailed breakdown of each and every component of the salary slip:

Earnings

Basic Salary

A basic salary is a defined sum that is provided to an employee before any allowances or deductions are taken into account. The base compensation is usually 35-50% of the total compensation. It serves as a starting point for the other components of one’s salary. Basic pay is usually kept low and it tends to be high at junior levels. It is included in the take-home salary and if a basic salary exceeds the income tax slabs, it is fully taxable.

Dearness Allowance

Dearness Allowance DA is compensation granted to employees to help counterbalance the effects of inflation on their salary. It normally amounts to 12% of the basic salary. Employers in India, Pakistan, and Bangladesh give Dearness Allowance compensation as a living cost adjustment to fight the impact of inflation. Employees of the government, the public sector, and retirees have access to DA, and it is determined automatically. Basic income and DA are fully taxable. It appears after the basic pay on the income side of the employee salary slip or salary statement. DA is a part of your take-home pay.

House Rent Allowance (HRA)

Employees who live in a rented house are eligible to get the House Rent Allowance. The HRA is based on the employee’s residential city. In a metro city, HRA is equal to half (50%) of the basic pay. In all other cities, it is 40% of the base pay. The housing rent allowance is free, paying income tax up to a specific limit as long as the individual pays the rent. You can find it on the income side of the employee salary slip. House Rent allowance enables you to save money on taxes. To avail of the tax exemption there should be at least one of the following:

- Rent paid annually – 10% of the salary (Basic + Dearness Allowance)

- The full amount of House Rent Allowance received

- 50% of salary (Basic + Dearness Allowance) for Mumbai, Delhi, Chennai, Kolkata.

- 40% of salary (Basic + Dearness Allowance) for other cities.

Conveyance Allowance (CA)

Conveyance allowance, also known as the travel allowance, is a monetary allowance or reimbursement for an employee’s travel expenditures between home and work. It is a concession, and it is also tax-free up to a certain point. It shows on the salary slip’s income side. Conveyance allowance also plays a role in helping you save money on taxes. Conveyance allowance is also a part of your take-home pay. To avail of the tax exemption with CA, there should be at least one of the following:

- A maximum monthly limit of INR 1,600

- The full amount of Conveyance Allowance received

Medical Allowance

Every month, the employee’s account is credited with a specified sum as a medical allowance in addition to the salary. The allowance is provided for medical expenditures incurred during the course of work. Medical benefits are determined according to the contract’s applicability to employees. Medical benefits are determined according to the contract’s applicability to employees. But the employee is only paid this allowance if bills and documents of the medical expenses are submitted as proof of spending. If the employee fails to provide proof of medical costs, the allowance will be paid, but it is subjected to full taxation. If documentation is submitted, the allowance is only tax-free up to INR 15,000 in this situation. You can find medical allowance on the salary slip’s income side. This is also a part of your take-home salary.

Special Allowance

Performance-based allowances are a type of special allowance. They are typically provided as a mode of encouragement to motivate staff to do a better job. Furthermore, these allowances differ from one firm to the next. Special allowances are taxed at their full value. It shows on the salary slip’s income side. And this is a part of your take-home pay.

Deductions

Professional Tax

State governments impose a small tax on earning professionals known as professional tax. It’s only available in a few states. It is imposed not just on professionals, but also on anybody who makes a living by any means. The professional tax amount is taken out from your income which is taxable. Every month some of the money is taken out from the salary. You can find it on the salary slip’s deductions page. It’s important to note that professional tax is deducted from the gross salary. Based on the established bands, the maximum amount required to pay by an individual per year is INR 2,500. It is usually roughly Rs. 200 per month.

Tax Deducted at Source (TDS)

Tax deducted at source is the amount of money deducted by the company as an income tax from an employee’s salary. This tax is deposited by the employer with the Income Tax Department. It’s important to note that income tax too is deducted from the gross salary. This amount is usually estimated by the gross tax bracket of the individual.

This tax can be reduced by investing in tax-free assets such as equity mutual funds and tax-saving FDs. This income tax is collected in advance by the company and they deposit it on behalf of the employees. The amount is withheld from your salary when you pay your income tax using the TDS certificate provided by your employer. TDS returns can be claimed by mutual fund investment and submitting your investment evidence to the business.

Employee Provident Fund (EPF)

The accumulation of assets for an employee’s retirement period is known as a provident fund. The employee contributes a certain amount from his pay under this plan. This proportion is set by the government. It is currently at 12% that the EPF takes from the basic wage of the employee. Added to this, on behalf of the employees, the company also makes a comparable payment towards their retirement. Please note that the employee provident fund is deducted from the gross salary. When this reaches maturity after 15 years, the entire PF balance, including the interest earned, can be withdrawn tax-free.

Templates for monthly salary slip

Organizations usually use payroll software to generate salary slip templates. Here are some of the templates of the salary slips that you can use if you own a company or have some employees:

Salary payslip format 1

.png)

Salary payslip format 2

.png)

Salary payslip format 3

Final Thoughts

The monthly salary slip of the employee is a significant legal proof that serves as verification of his income. As a result, if your organization does not provide you with a payslip, you have the legal right to request one. Nowadays all organizations provide either a printed version of the salary slip or email the salary slip in PDF format to their employees so that they may access it at any time. They can also be found in the internal HRMS portal of the company.

Frequently Asked Questions

How to verify the salary slip?

You can verify pay slip by contacting the previous organization, checking with background verification agencies, checking digital signatures on secure QR codes over the payslip (if any), and cross-verifying the calculations on the payslip on deductions and earnings mentioned in offer letter of the company.

Why is it important to understand salary slips?

Since a salary slip is a legal proof or document that provides evidence for salary claim and future employment, it is important to understand all the components of salary slips. It also helps in getting loans and mortgages sanctioned.

Is it the duty of HRs to verify salary slips?

Yes, it is the duty of the HRs to verify the salary slips of all the employees and newcomers. It is essential to verify them every month for all existing employees and during the background verification for newcomers.

Can a salary slip be edited?

Yes, a salary slip can be edited if it is sent in a PDF file format. But it is not advisable to edit a salary slip to manipulate the income. In some cases, it is considered a criminal offense.

What is the utility of a payslip?

A salary slip or payslip plays an important role in proving employment with the prospective employer and getting other benefits like loans and credit cards. In case of a new job opportunity, the new employer will always ask for the previous salary slips for the last three months.

Also, If you are looking for an HRMS that can manage your employees salaries on a monthly basis, visit www.sumhr.com and get started with the all-in-one HR & Payroll software in India

Do banks check payslips?

When you apply for a loan from the bank or a credit card, bank representatives frequently want a wage slip. It indicates that you are employed by the specified business or organisation and receive a fixed monthly salary.

Are handwritten payslips legal?

Yes. The salary slips may be printed either by hand or supplied online. The value of the handwritten pay stubs is equal to that of the ones generated electronically. It is possible to provide a copy of handwritten pay stubs as job documentation or when applying for bank loans, etc.

What is professional tax?

Your employer withholds professional tax, a type of direct tax, from your gross wage. Since the state government imposes this tax, the amount you pay will depend on the state where you reside.

What are the tax benefits that can be claimed on HRA?

By supplying your monthly rent receipts, you can apply for HRA exemptions. However, bear in mind that if you spend more than Rs. 1 lakh per year, you are required to declare the PAN card information of your property owner.

How to calculate taxable income?

Your taxable income is your gross income less all allowable deductions. Before utilizing any available tax credits, estimate how much you’ll owe by comparing that sum to your tax bracket. Since it provides an estimate of how much you will owe the government, predicting your taxable income before submitting your tax return can help you avoid surprises.