Managing the financial future and getting a comfortable retirement is important for every working individual. In this pursuit, Employee Provident Fund (EPF) has been one of the cornerstones of India’s social security system, offering financial security to millions of people.

As employees and employers diligently contribute to the EPF account, it is essential to understand every component of the contribution, including the EPF administration charges. It refers to the amount charged by the Employees’ Provident Funds Organisation for managing and handling the EPF accounts of salaried individuals.

The administration charges are a small percentage of the employer and employees’ total contribution to the EPF account. It covers the expenses incurred by the EPF organisation in controlling the accounts, processing contributions, handling professionals, and other related services. Government policies change over time, and the percentage also gets updated yearly. Let’s delve into the benefits of EPF administration charges and how it impacts the EPF account.

Contribution of the EPF Account

The EPF contribution is different for both the employer and the employee.

Employee – 12% of the employee’s basic salary+DA

Employer –

- 3.67% into EPF

- 8.33% into EPS

- 0.5% into EDLI

- 0.50% into PF administration charges

The PF admin charges are at least INR 75 per month for all non-functional establishments without contributory members and INR 500 for the rest of the companies.

Calculation of the PF Administration Charges

When an employee’s salary basic salary is 15,000 and dearness allowance is 3,000, PF contributions on the salary (15,000 + DA) will be as follows:

|

Contribution |

Employer |

Employee |

|

EPF |

18000*3.67%= 661 |

18000*12%= 2160 |

|

EPS |

18000*8.33%=1499 |

– |

|

Admin Charges |

18000*0.50%=90 |

– |

|

EDIL |

18000*0.50%=90 |

– |

How Do the EPF Administration Charges Affect the Provident Fund?

PF admin charges are not only an expense for the employer but also affect the fund balance in many ways, like the following:

- Reduction in Final PF Balance

The EPF administration charges are deducted from the employer’s contribution and directly deposited into the EPF account. As EPF is based on the power of compounding, the interest is calculated on the principal amount and the interest earned previously. By reducing the employer’s contribution, the admin charges indirectly reduce the compounding amount.

- Lower Interest Earnings

The EPF administration charges are deducted from other charges like EDLI or EPS, decreasing the total PF fund balance. A lower fund amount generates less interest for the employee. Moreover, due to the compounding effect, this effect can present a substantial loss of money.

- Impact on Retirement Corpus

The EPF account is known for providing retirement benefits and financial security to employees. Reducing the PF balance for administration charges affects the retirement corpus. The HR department calculates the fund amount through a staff attendance and payroll management application.

- Impact on Withdrawals

Some people withdraw their PF balance before retirement due to financial emergencies. The administration charges reduce the amount to be received by the employee. The admin charges affect withdrawals for marriage, education, or unforeseen medical emergencies.

Factors to Consider for Administration Charges

The PF admin charges depend on an employee’s basic salary and dearness allowance and other factors, like the following:

- Higher Salary

Employees with a high salary face high admin charges as a part of the percentage calculation from the monthly wages. It means that a more significant portion of the employer’s contribution goes into paying admin charges to the EPFO authorities. Larger admin charges lower the amount of investment in the EPF account, which leads to a lower corpus at the time of retirement.

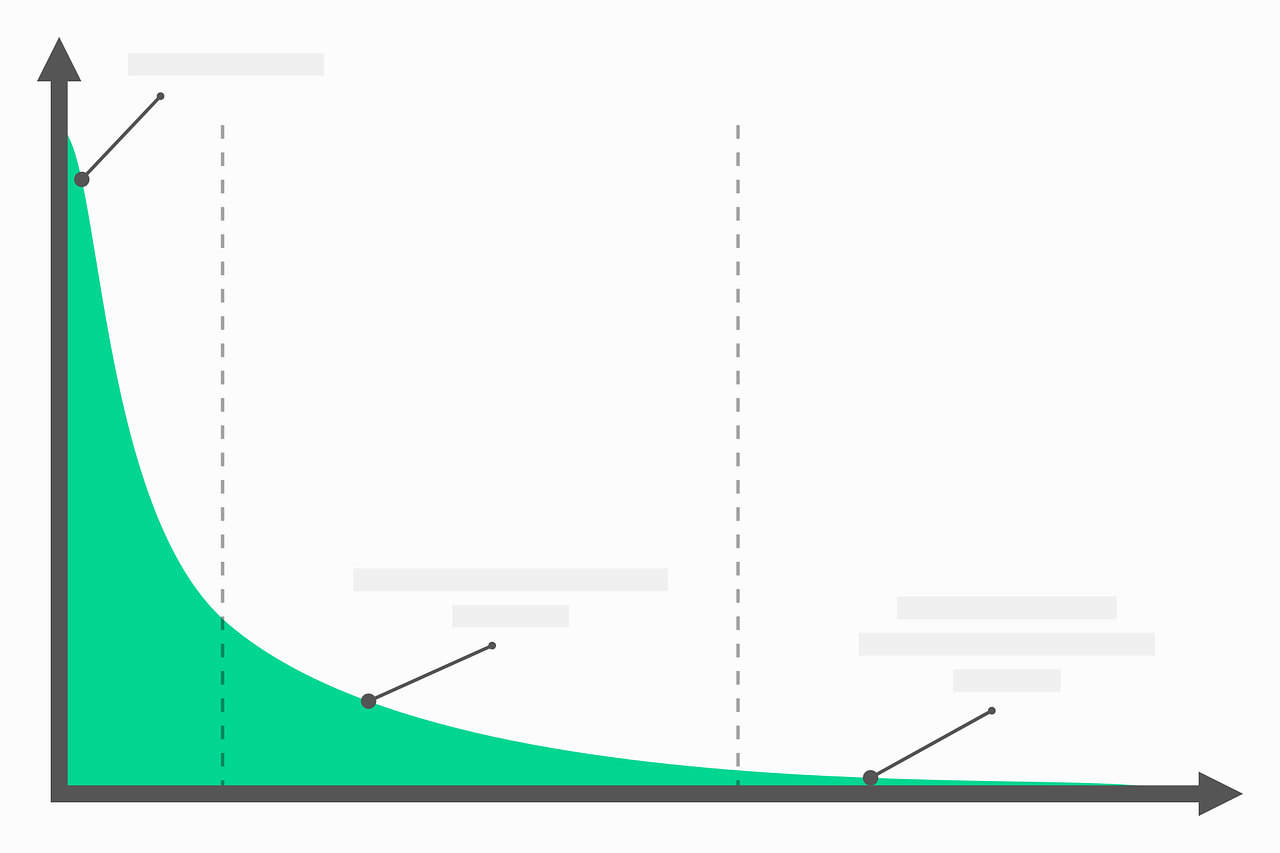

- Longer Employment

When an employee works for a long duration in their life, the impact of admin charges is higher. As the charges are paid to the authorities monthly, it takes away a significant portion of the PF savings amount in the long run. Therefore, employees can look for other investment options like Voluntary Provident Fund (VPF) or Public Provident Fund (PPF) to extend their savings and get a higher rate of return.

Importance of PF Admin Charges

PF admin charges may be an expense for the employer, but they also have potential benefits. Let’s see the importance of these charges for the EPFO authorities:

- Fund Management

EPF admin charges are known for effectively managing the fund. EPFO authorities manage a large amount of money the employer and employee contribute, so they require some compensation. Admin charges pay for the allocation, collection, and fund distribution charges to the respective employees at their retirement.

The admin charges help cover the costs of maintaining accurate records and managing transactions. It ensures that all the charges comply with the companies’ legal and regulatory requirements. It is easier for authorities to maintain a well-functioning system with admin charges.

- Infrastructural Development

EPF admin charges contribute to the development and improvement of the EPFO infrastructure. It helps authorities invest in technology or upgradation, software systems, and other technological tools. All these improvements enhance the efficiency and effectiveness of EPF operations. Infrastructural development helps the EPF streamline the process, reduce errors, and provide better employee services.

- Customer Support and Services

EPF admin charges help address members’ queries, concerns, and requests. It includes assisting with account-related matters, handling claims or withdrawals, and facilitating the transfer of funds. Administration charges cover the cost of maintenance and ensure a smooth and hassle-free experience for EPF members.

- Sustainability and Growth

Admin charges are also effective in contributing to the overall growth of EPFO members. These charges enable the authorities to allocate funds to research and development activities, financial planning, and investments. Through improving the investment portfolio, EPF can generate higher returns which benefits both the members and employees through increased savings and better retirement benefits. As the central government changes the admin percentage occasionally, it is essential to stay updated on the latest information or consult the EPF authorities.

- Wrapping Up

In conclusion, EPF administration charges have a tangible impact on the employee’s PF account and fund savings. All these charges are necessary to benefit from the retirement fund and ensure the smooth functioning of the EPF scheme. Employees should understand these charges while planning their retirement.

While the impact of admin charges is small in the short term, their cumulative effect on the total amount influences the fund majorly. Employees must stay informed on the current EPF administration charges and seek professional advice to make informed decisions about their EPF contributions and financial goals.

sumHR offers cloud-based human resource management software that helps different companies streamline their human resource processes and record employee data. Our biometric attendance system with payroll software has gained popularity for innovative solutions and customer support catering to diverse clients across industries. sumHR’s commitment to an efficient HR process scales and solidifies its position as the leading HR tech partner.

FAQs

- Do PF admin charges affect the interest earned on the provident fund?

Yes, the PF admin charges affect the interest on the sum of the provident fund. The reduced balance due to the admin charges leads to lower interest earnings, which impact the compounding of the provident fund savings.

- Can employees withdraw the PF admin charges while leaving their jobs?

No, the PF admin charges are non-refundable and directly go to the EPFO authorities for their development. It is a one-time payment by employers and cannot be withdrawn by employees while leaving their job. Employees can only withdraw the fund amount at retirement or before, in some situations.

- Can employers waive the PF admin charges?

Per the EPFO guidelines, all employers employing at least 20 employees must contribute to the PF admin charges, and there are no exceptional provisions stating the waiving of charges. Avoiding paying these charges can attract legal penalties.

- Where can employees find the current PF admin charge rates?

The current PF admin charge rate per the government policies is available on the official website of EPFO, or employees can contact their respective EPFO office.