The Payment of Bonus Act 1965 is an important law for any employer to comply with in India. It ensures the payment of bonuses to people employed in an establishment, thus ensuring employee welfare. The Payment of Bonus Act provides financial security for employees and helps improve employee morale, acceptance of work, and loyalty towards the organisation. These are the key elements of HR roles and responsibilities .So, let’s explore the intricacies of the Act to learn how to keep your workforce happy and motivated.

Essentials of the Payment of Bonus Act 1965

- Applicability

Parliament passed this Act in June 1965, which applies to all establishments employing 20 or more persons. The Act applies to all non-government and public establishments, departments, corporations, and other public sector undertakings. It includes permanent, contract, temporary, casual, unskilled manual, factory workers, part-time employees, and administrative employees with a salary under INR 21,000.

The scope of this Act does not apply to people working in seasonal businesses or those hired by contractors. The employee must have spent at least 30 days a year working in the manufacturing or company.

Under the Payment of Bonus Act, employers must pay employees an annual bonus calculated based on profits or wages earned during an accounting year. This bonus can be up to a maximum of twenty per cent (20%) of the salary drawn by an employee during this period.

- Maximum Bonus Payable

Under the Payment of Bonus Act of 1965, the maximum bonus payable equals twenty per cent of each employee’s salary or wage during the accounting year. However, this maximum limit applies only when the allocable surplus exceeds 8.33% of the total salary or wages paid over the accounting year.

- Minimum Wages

The Payment of Bonus Act also stipulates that no employee shall be entitled to any bonus unless paid minimum wages for all hours worked during a given period.

- Bonus Calculation

Only an employee’s salary, wages, and daily allowance are considered for the computation of bonus during the accounting year, subject to a maximum of twenty per cent. Here’s how the calculation goes:

- If the sum of an employee’s Basic Salary and Dearness Allowance is less than INR 7,000, then the Bonus Payable will be calculated as a percentage of the Basic Salary and DA, either at 8.33% (which the establishment is required to give even in case of a deficit) or up to 20%.

- If the sum of an employee’s Basic Salary and Dearness Allowance is greater than INR 7,000, the Bonus Payable will be a fixed amount of INR 7,000, with the percentage calculation being either at 8.33% (which the establishment is required to give even in case of a deficit) or up to 20%.

It must be noted that medical attendance, retrenchment compensation, any gratuity or other retirement benefit payable to the employee, attendance bonus, value of any house accommodation, and any concession supply of food grains or other articles are not included in the calculation of bonus under this Act.

- Disqualification of Bonus

The Bonus Act provides for certain cases in which employees are not eligible for bonuses. These include:

- Instances of negligence

- Dishonesty

- Theft

- Sabotage of any property of the establishment

- Violent behaviour on duty

- Wrongful exercise of power by an employee

Furthermore, employers may disqualify employees from receiving their bonus if they do not accept their bonus payment within one month after it has been paid. It could also happen if employees fail to complete any terms of employment or pay any dues as per the relevant regulations.

- Statutory Compliances on the Part of the Employer

- Employers have certain compliance requirements which mandate that all eligible employees should receive a minimum bonus payment.

- Employers must pay bonuses at least once a year and calculate them based on their allocable surplus and other criteria. Employers must also provide reasonable time for employee acceptance of their bonus payment.

- In addition, employers need to ensure that benefits such as maternity benefits, development allowance, and social security are considered when calculating bonus payments.

- Furthermore, employers have to deduct direct taxes from the total bonus due to employees and pay it within a specified period.

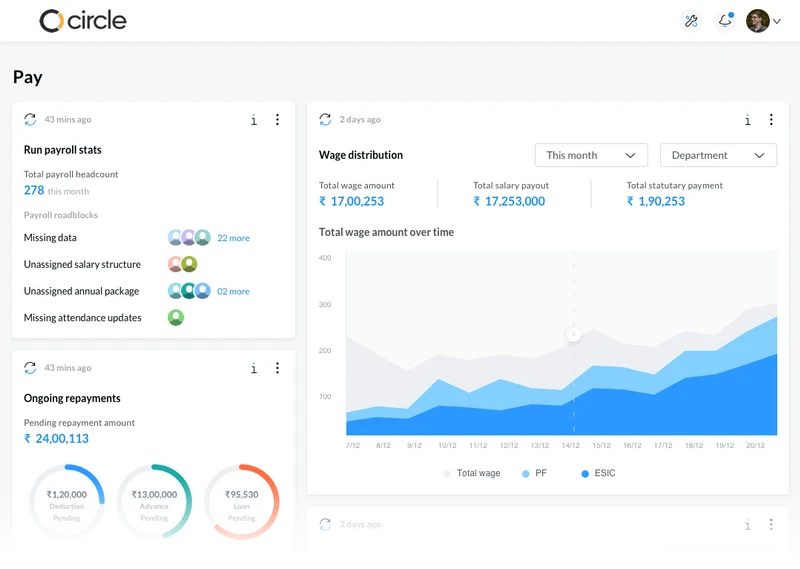

- Finally, payrolls must be maintained accurately so that any disputes arising from the incorrect calculation of bonuses can be resolved quickly through appropriate redressal mechanisms.

- Rights of Employers

The Act provides certain rights to employers and the obligations that must be fulfilled.

- The ability to bring any dispute before a labour tribunal or court.

- The employer must not pay a bonus if an employee has been dismissed due to violent behaviour or other misconduct.

- Furthermore, the employer can adjust any expenditure incurred by them on account of social security and provident fund against bonus payable under this Act.

- Additionally, employers have the right to set their terms of employment for payment of wages and bonuses as long as they adhere to the provisions of this Act.

- Suppose the employer has already paid a “puja bonus”, a customary bonus, or a bonus before the bonus becomes payable. Then, the employer can subtract the bonus amount from the actual bonus. Consequently, the employee will receive the balance.

Lastly, it can be innovative for employers and HR Managers to use performance review software or other methods for determining benefits such as expense reimbursements or development allowances given to employees.

- Rights of Employees

The Act allows workers to earn more than the minimum wage or pay. The following rights are granted to employees under the said Act:

- Right to claim any bonuses owed to them under the Act. It entitles them to submit a request to the government for payment and recovery of any bonuses not given to them within a year of their due date.

- The ability to bring any dispute before a labour tribunal or court. However, it’s important to note that employees who aren’t eligible for bonuses cannot bring their case before one of these bodies.

- Employees are entitled to request clear and comprehensive information about all products that belong to a company to assess whether they are being justly remunerated for their work.

- Proper Documentation and Record-Keeping

Records must be kept in the following formats:

- Form A, which contains the whole computation of the allocable surplus

- Form B, which displays set-offs and adjustments

- Form C, which contains information about the bonus due, the deductions to be made, the amount distributed, and other data

Record keeping for bonuses is yet another Human Resource Management activity that the managers will take up under this Act.

- Offences and Penalties

The penalties under the Act are severe and apply equally to all employers, regardless of company size.

The most common offenses include:

- Failure to pay the bonus to employees within the time limit

- Failure to comply with orders or requisitions made by the Central Government or State Government

- Non-payment of minimum bonuses

- Non-payment of benefits such as development allowance, maternity benefits, etc.

In case of violation of any provision under the Act or rules, employers are liable for imprisonment for up to six months or may be imposed with a fine of INR 1000 or both. Companies, firms, body corporate, or associations of individuals whose director, partner, or principal employer is responsible for the conduct of its business shall be deemed guilty unless proven otherwise.

The Payment of Bonus Act of 1965 aimed to make it permissible for various organisations to pay bonuses. It offers an objective method for calculating bonuses based on the company’s performance and profit. An organisation’s employees are rewarded for their work by receiving a portion of the profits.

sumHR is a cloud-based HR management system for small and medium-sized businesses. Visit our website to streamline your HR processes!