Small and medium enterprises (SMEs) heavily back the Indian economy; the revenue from SMEs accounts for about half of the country’s GDP. As businesses strive to grow, traditional (manual) payroll systems might not cope with the emerging competition. Small business owners spend almost 41 hours on tax calculations and payroll annually. It is daunting for front and back-office operations, especially considering their small workforce. Fortunately, automated payroll systems bring changes to manage finances and streamline business operations.

If you are looking for an effective way to save time constraints and money, read this blog to explore different strategies to implement automated payroll systems.

What Are SMEs?

Small and medium-sized enterprises (SMEs) are the group of businesses with less than 500 employees. They cover most business activities (manufacturing, infrastructure, service industry, etc.) in developing countries like India. However, these companies are vulnerable to economic fluctuations due to the lack of resources.

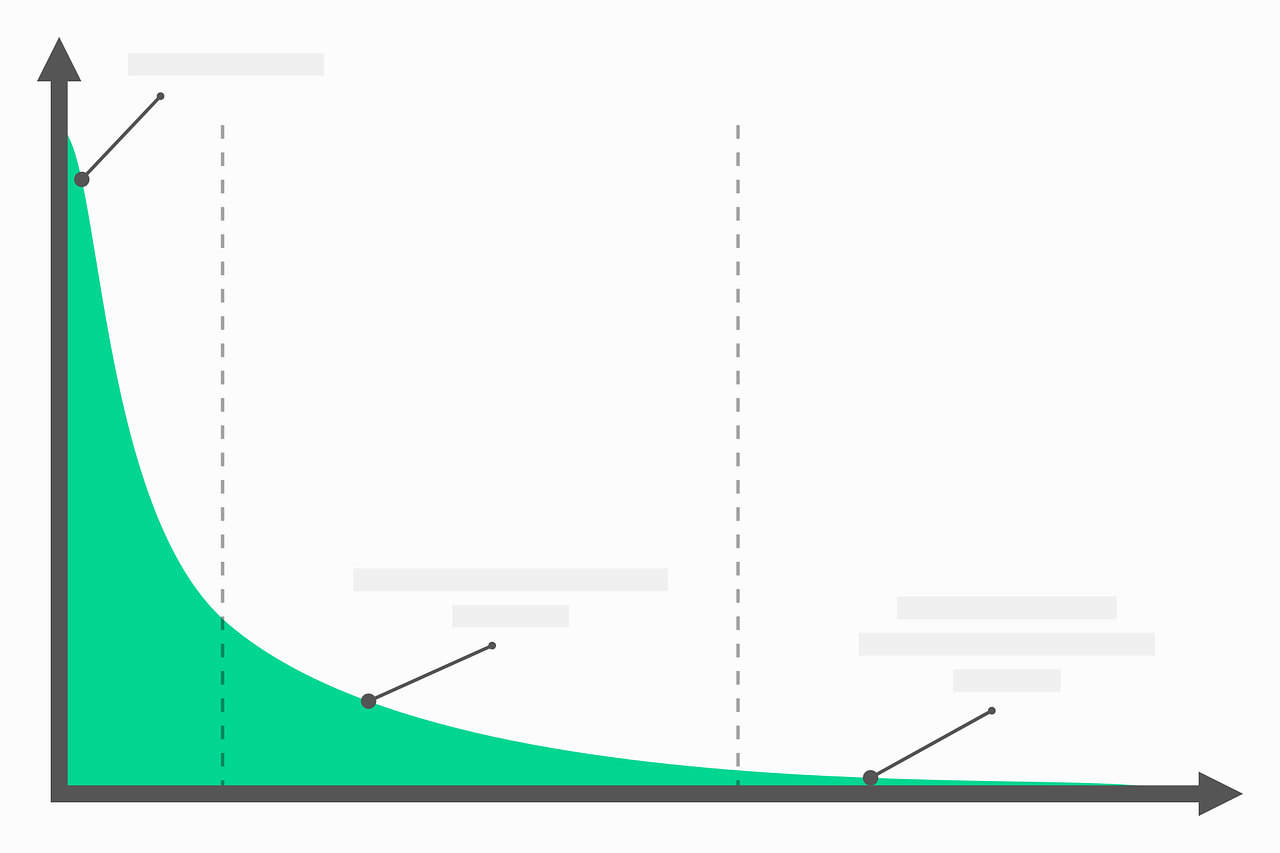

Around 20% of small businesses fail in the first year of operations, which rises upto 80% in the 10th year. A business must have efficient systems for strategic decisions and smart task delegation. These systems can improve productivity, letting companies remain competitive and at par with giant corporations. Automated payroll systems are a great way to enhance SMEs’ capabilities in accomplishing their goals.

Further, let’s explore the benefits of implementing an automated payroll system in Indian SMEs.

Types of Automated Payroll Systems

- Cloud-Based Payroll Software

This automated payroll software allows users to access and manage payroll data anytime. The company needs an internet connection to measure the accuracy, security, tax filing and customisable reporting options.

It allows enterprises to track employee hours, deductions, pay rates, vacations, and holidays with just one click from one platform. The scalability and customisation of this payroll system enable adding or removing new features from the platform.

The system reduces calculation errors by providing transparency in employee payments and finances.

- Self-Service Portal

Around 25% of small enterprises use pen and paper to track finances, and over 45% of businesses do not have independent accountants. Self-service portals are beneficial for managing the payroll system. It enables employees to access payroll information with a unique ID and password.

Employees can receive pay slips, updated bank details, sick and leave records and more from the platform. They can also view tax withholdings, deductions, and other financial information.

With these self-service portals, SMEs reduce time on manual tasks like data entry or bookkeeping. Further, it is a secure platform offering multi-factor authentication to protect sensitive data and remove unauthorised access.

Benefits of Automated Payroll Systems for SMEs

Below are the benefits that make automated payroll systems an excellent choice for SMEs looking to improve their financial management:

- Better Accuracy

Therefore, making mistakes can be costly for SMEs in India. It can even lead to legal action because of wrong salary computation. However, with the automated system, businesses can easily calculate employees’ withholding taxes and salaries. It eliminates the risk of penalties and human errors in the payroll process.

- Tax Calculations

Tax calculation is one of the most complex and time-consuming procedures. 40% of business owners state tax calculations as the worst part of owning a business.

With an automated payroll system, this process has become easy by saving valuable resources. Companies can generate detailed reports for compliance with tax regulations. These reports provide evidence to employers about employee taxes, making audit and review smoother.

- Report Generation

It allows employers to stay up-to-date with the employee’s payroll information and smoothens the tracking process. The automated system generates reports of:

- Overtime hours

- Paid leaves

- Taxes paid

Businesses can generate reports in PDFs, Excel spreadsheets, or webpages. The system also shows analytical insights into employee wages, enabling employers to make informed decisions on cost-cutting measures and other financial considerations.

36% of organisations have improved productivity, and 7% have reduced human errors in payroll with automated systems.

- Time-Saving

It is one of the crucial aspects of implementing an automated payroll system for SMEs in India. The automated system reduces manual data entering involved in processing payroll. It lets HR managers focus on core areas instead of tedious data entry during business hours. It can generate employee salary statements from multiple locations.

- Updates & Payments

Every year, tax tables and superannuation cost rise and become complex, making it difficult for small and medium enterprises to comply with them. However, automated payroll system updates align with federal and state requirements. It saves time by electronically processing the payouts of employees monthly.

Human resource management staff can access internal and external payroll information from one platform. They can get complete control of the payroll processing due to task automation.

- Convey Information Safely

Automated payroll systems securely track employee information in one platform. All the data are available online and are accessible from multiple locations through the internet. Employers can access or edit the information from the office, home or outside. Sharing sensitive information with the payroll company and concerned parties is easier without data breaches.

- Data Encryption from Hackers

With the automated payroll system, small and medium enterprises can protect sensitive information from cyber-attacks and security breaches. All the information is encrypted and protected from hackers, making it safe. It reduces theft and crimes and keeps confidential data intact within the organisation.

- Integrated Support

Indian SMEs struggle to divide their time between operations and calculating data like leave, attendance, and employee information. This is an issue when processing payroll and tax with the pen-and-paper payroll system. With an automated payroll system, businesses get support from an integrated framework to act singly from one platform for all employee groups. It saves time and verification of data and information before processing payments.

- Uninterrupted Support

When small and medium enterprises used pen-and-paper payroll processing systems, human resource management was dependable on employees. However, what happens when employees leave? An automated payroll system offers continuous and 24*7 customer support to resolve problems.

Cost Consideration and Implementation Strategies for Indian SMEs

The cost of purchasing an automated payroll system may seem high initially. Still, it rewards the business with long-term investments. With careful planning and support from professionals with HR and technology experience, businesses can ensure they are getting the most out of their new system.

Now, let’s look at how to assess the expected return on investment to maximise your company’s potential!

- Cost Considerations & ROI Analysis

Around 20% of medium and 80% of small enterprises refrain from investing in HRMS (human resource management system) and payroll processing for budget constraints. Therefore, ROI (return on investment) analysis is essential for decision-making. It evaluates the necessity and budget to purchase software, intake training costs, and bear maintenance costs. The enterprise should also measure the time and resources required for a suitable system.

Every business should maximise its ROI by considering quantitative and qualitative aspects. The former involves assessing the direct financial benefits for increased efficiency and accuracy. The latter evaluates indirect benefits such as improved employee satisfaction or reduced HR roles and responsibilities.

- Implementation Strategies & Checklist

SMEs must develop strategies to streamline the system implementation process, including a checklist of tasks. The list can include:

- Meeting business needs

- Hiring training staff

- System configuration

- Data migration

- Testing the new system before the launch

- Establishing maintenance procedures

All small and medium enterprises should have a clear set of goals and responsibilities for HR personnel. It ensures the automated payroll system has been implemented with minimal disruptions and on time.

Wrapping Up

Therefore, implementing an automated payroll system benefits Indian SMEs in several ways. Businesses benefit from custom reporting and integration from the payroll systems considering their decisions, costs, scalability and customer services. When you involve human resource management and IT teams in practice, Indian SMEs progress to make their investments pay off in the long run.

At sumHR, our goal is to amplify the effectiveness of HR teams worldwide. We have designed a comprehensive cloud-based HR platform, providing a configurable, adjustable HRMS (human resources management system) to enable your HR personnel to automate tedious tasks, reduce confusion, and increase employee satisfaction. We firmly hold that human resource management can make or break an organisation.