A memorable HR journey, for employees to remember

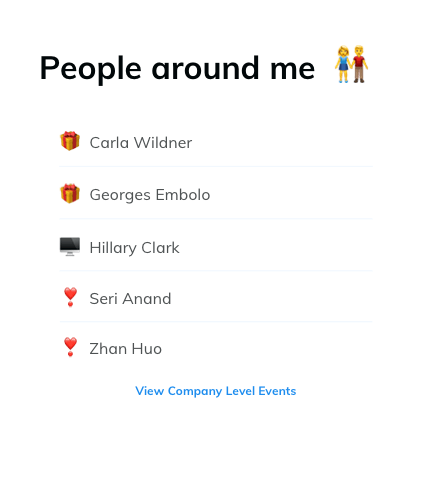

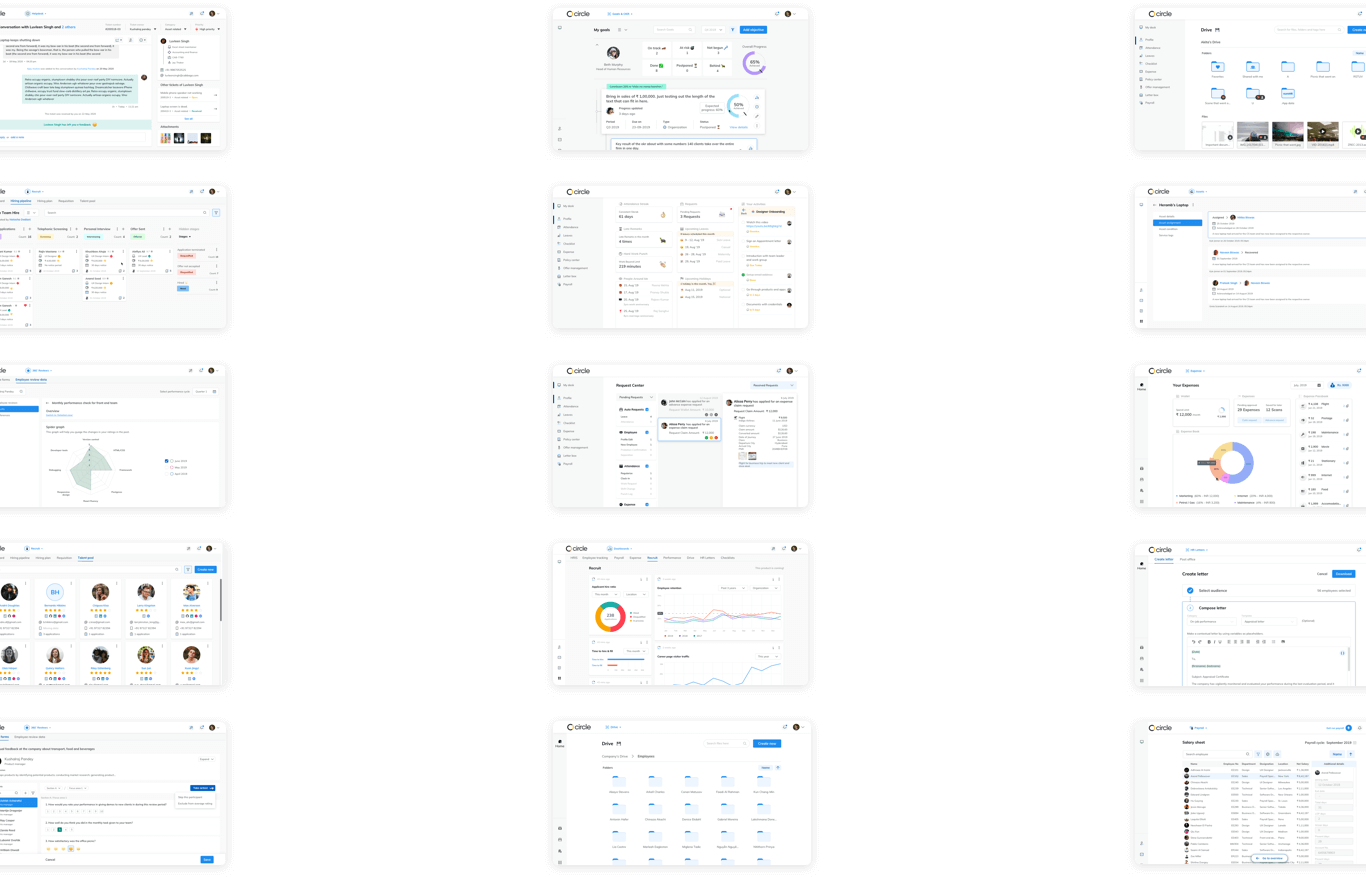

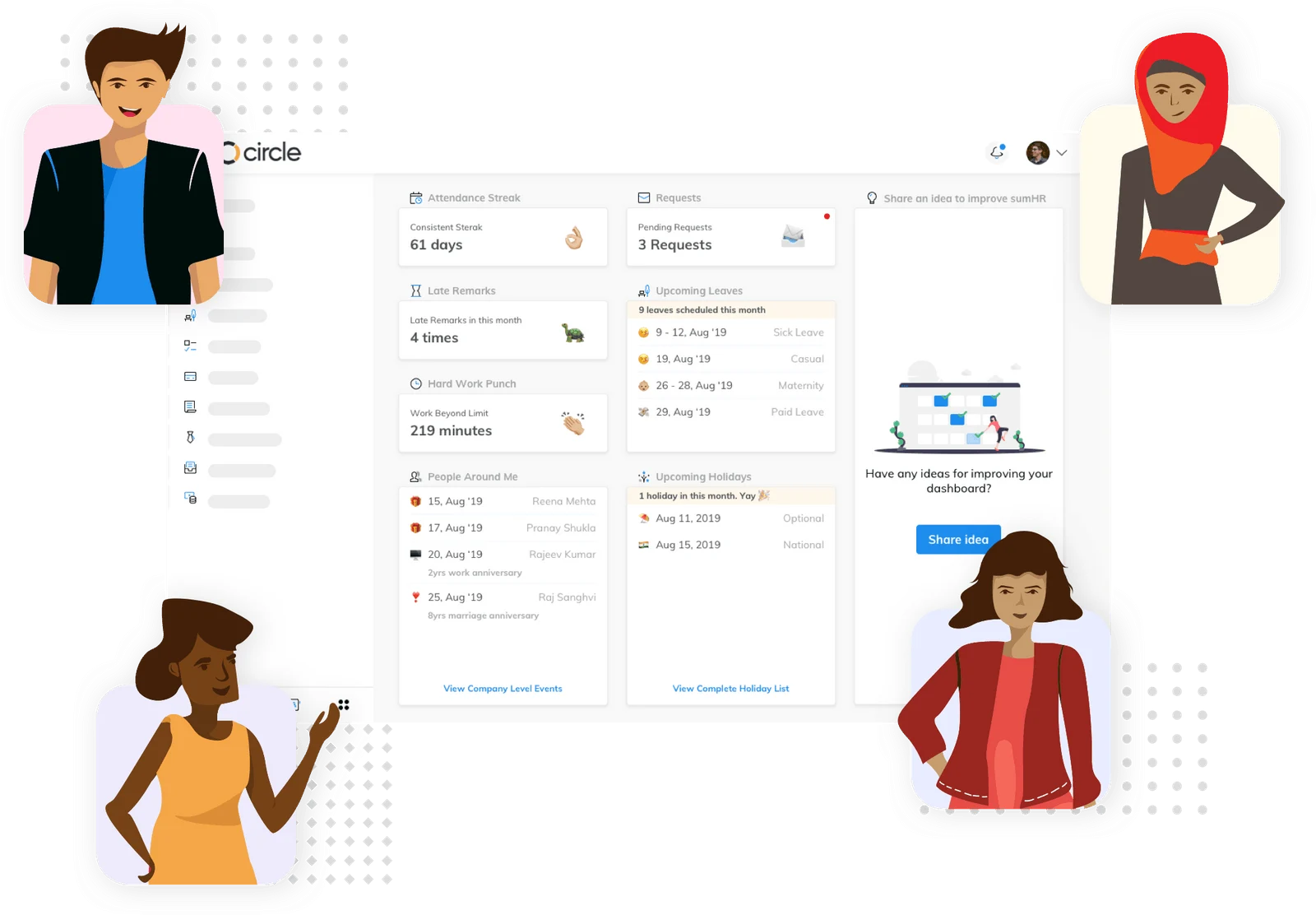

HRIS

Manage your HR Information

Employee profiles, company directory, org-chart and more! We make it really easy for you to manage HR data with self-service options – on web or mobile – which ensure it’s always up-to-date.

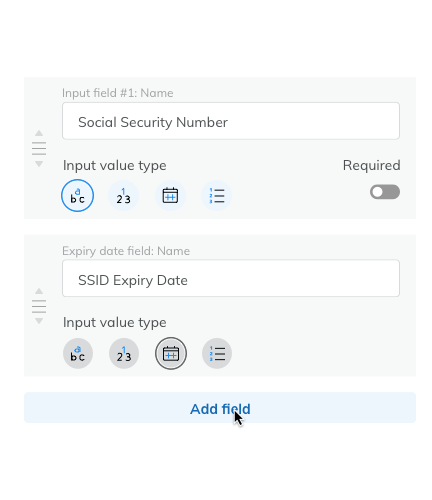

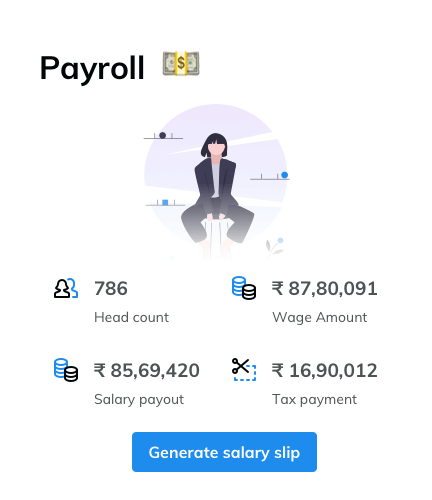

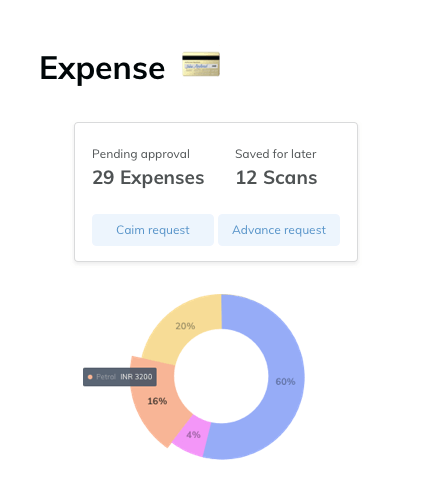

Payroll

Automate payroll & expense claims

Make payroll stress-free with our robust and reliable processing engine which not only automates the calculations but also simplifies the complications, not just for you but for your employees too!

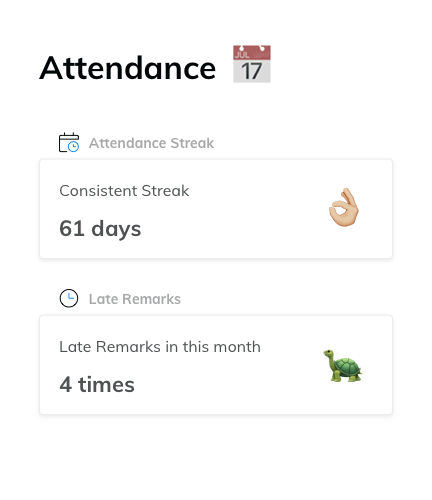

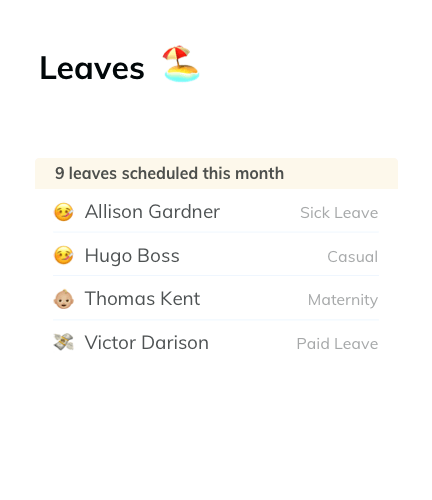

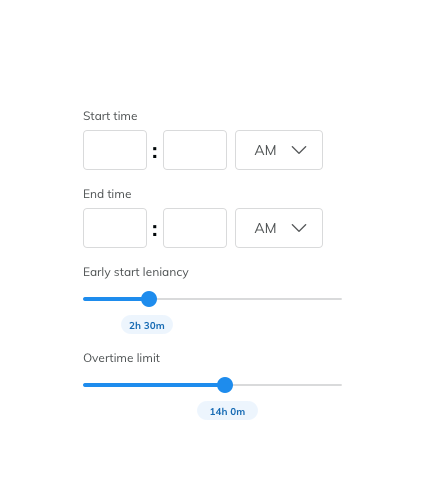

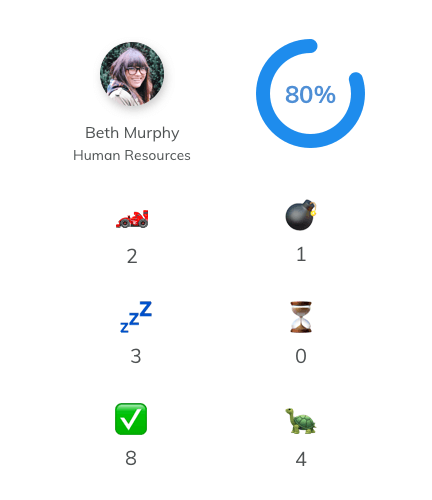

Attendance

Track attendance & time-off

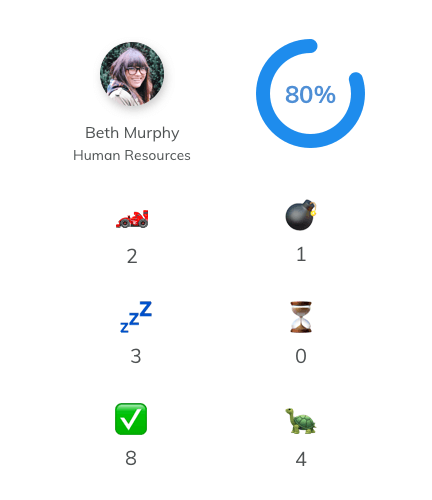

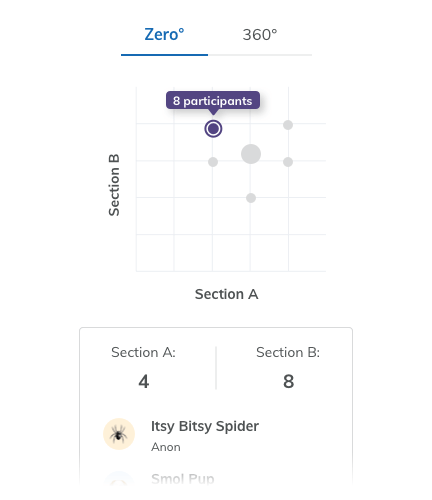

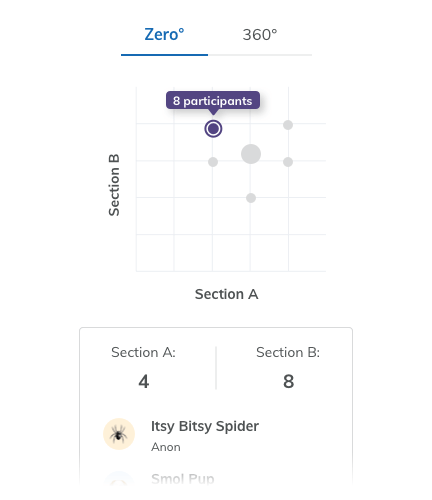

Performance

Review performance & OKRs

Set ambitious objectives, define expected results and check-in to measure goals regularly. Design unique feedback forms, conduct 360° performance reviews and establish a fair appraisal system.

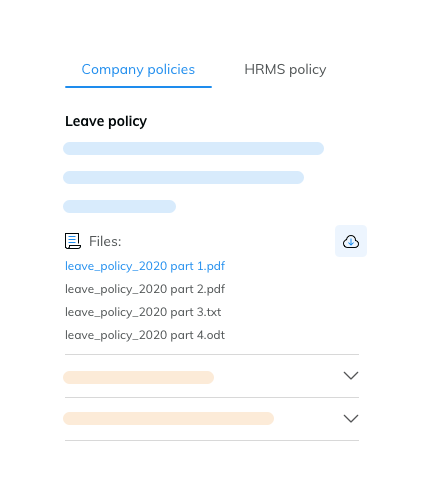

Operations

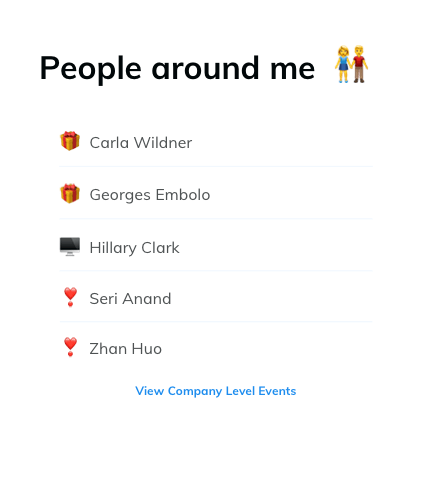

Organize HR operations

Put aside the paperwork and generate online HR letters from ready made templates, store important docs on the built-in HR drive, and optimize utilization of your IT assets with a smart inventory.

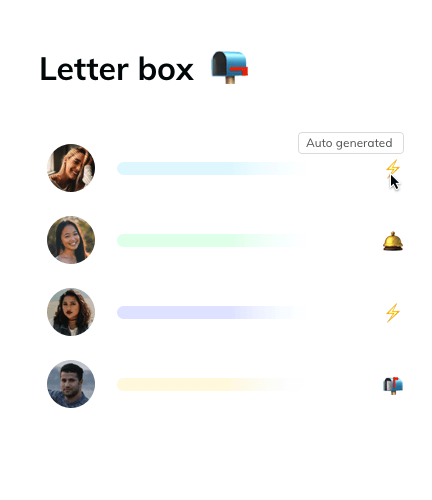

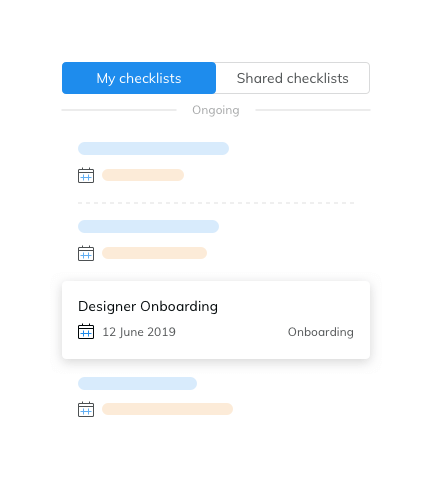

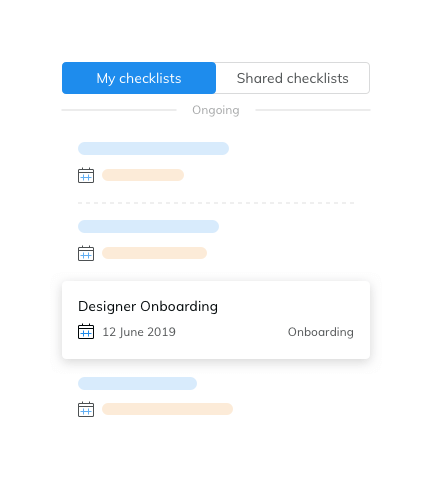

Onboarding

Streamine HR processes

Recruit (Coming soon)

Recruit candidates and make careers

HRIS

Manage your HR Information

Employee profiles, company directory, org-chart and more! We make it really easy for you to manage HR data with self-service options – on web or mobile – which ensure it’s always up-to-date.

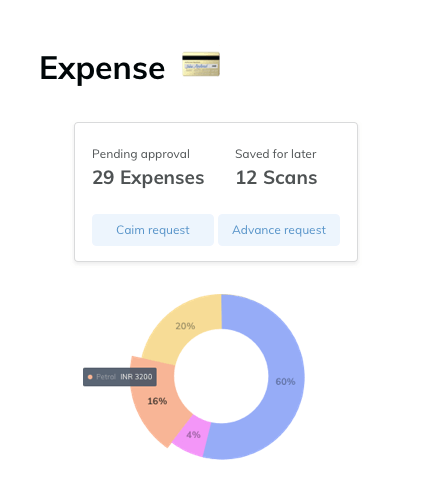

Payroll

Automate payroll & expense claims

Make payroll stress-free with our robust and reliable processing engine which not only automates the calculations but also simplifies the complications, not just for you but for your employees too!

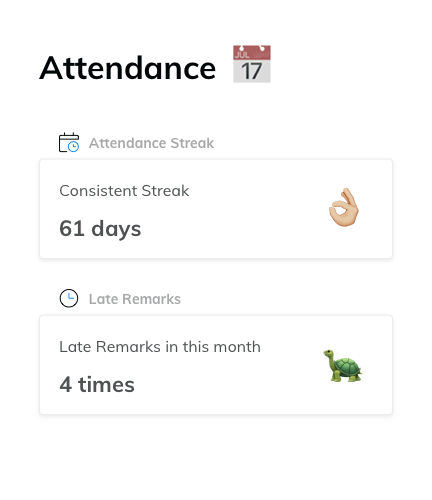

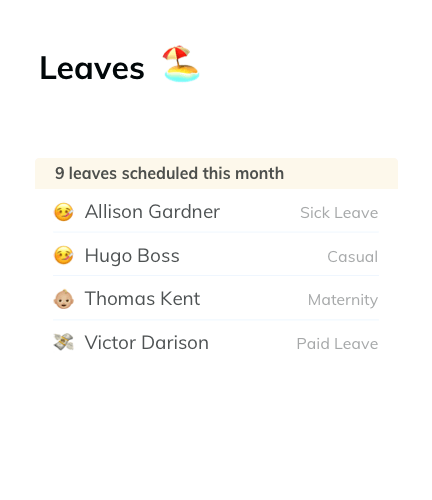

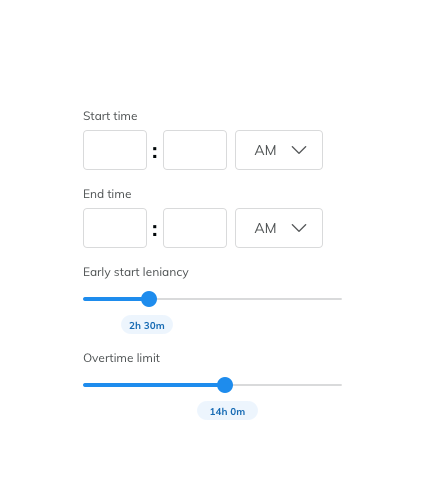

Attendance

Track attendance & time-off

Performance

Review performance & OKRs

Set ambitious objectives, define expected results and check-in to measure goals regularly. Design unique feedback forms, conduct 360° performance reviews and establish a fair appraisal system.

Operations

Organize HR operations

Put aside the paperwork and generate online HR letters from ready made templates, store important docs on the built-in HR drive, and optimize utilization of your IT assets with a smart inventory.

Onboarding

Streamine HR processes

Recruit (Coming soon)

Recruit candidates and make careers

We are fast, fanatic and funny (we think) when it comes to supporting you. We believe that features will come and go, but it’s how we make you feel that matters the most.

Awarded 4 years in a row. Best rated HRMS in the market!

We have had a wonderful experience since the time we began working with sumHR. It's a convenient, accurate and a cost effective HRM system, with reliable and prompt support.

Swati Bhargava

Co-founder

I am a totally satisfied customer and very happy with the sumHR team. It's certainly the best HR software I've used until now. Their support response times are impressive, and the TAT on complex issues is great too.

Aastha Sharma

4PL Consultancy

Even after 5 years, it's a wonderful experience using sumHR and our relationship continues to strengthen every year. It's a convenient, accurate and a cost effective HRM system, with reliable and prompt support.

Deepali Raut

Chowgule Construction Chemicals

It's actually like sumHR has become a part of our company. They understand our needs and remain available whenever needed. Their promptness with support is commendable.

Shruthi Reddy Sheri

Worldview

Take your first step towards bringing happiness in your HR! Our customer team will guide you.