Human resource departments all over the world juggle a multitude of HR tasks and responsibilities. From hunting the best talents across lengths and breadths to hiring and onboarding them, engaging them, and finally preparing their payrolls at the end of each month for years, their hands are always full of several HR roles and responsibilities.

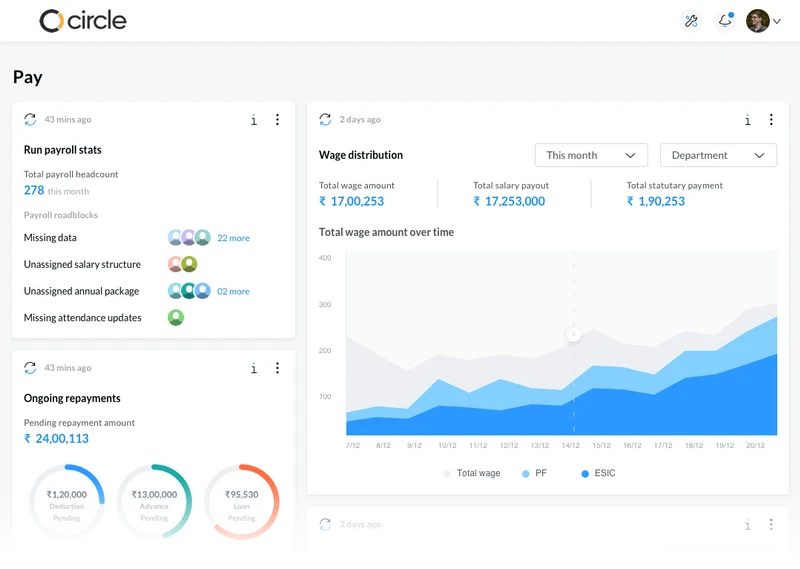

Running payrolls at the end of each month can be an overwhelming affair. This is because one has to take care of CTC, Basic Wage, House Rent Allowance, Travel Allowance, Dearness Allowance, Employee Provident Fund, Income Tax, Labour Laws, and so on for each employee in the organisation. Now, imagine repeating the entire process for 300-500 employees in various roles and designations every month yearly. It sounds exhausting, right?

If the process doesn’t already seem tricky and elaborate enough, imagine it in an Indian context where the HR departments must also consider various state and national labour regulations and statutory requirements and abide by the same. Moreover, there can never be room for even a single error unless you wish to incur the wrath of employees, management, government bodies, or all at once. Therefore, some companies have specialised payroll sub-departments within their HR department or outsource the entire process to a third party to overcome any hassle.

This article tries to look into the nuances of Payroll and Statutory Compliance in the Indian context along with social security as to what they are, what an efficient process looks like, and what can be the best practices that can be followed while managing payrolls of employees in India.

What is the Payroll System in India?

Human resource departments all over the world juggle a multitude of HR tasks and responsibilities. From hunting the best talents across lengths and breadths to hiring and onboarding them, engaging them, and finally preparing their payrolls at the end of each month for years, their hands are always full of several HR roles and responsibilities.

Running payrolls at the end of each month can be an overwhelming affair. This is because one has to take care of CTC, Basic Wage, House Rent Allowance, Travel Allowance, Dearness Allowance, Employee Provident Fund, Income Tax, Labour Laws, and so on for each employee in the organisation. Now, imagine repeating the entire process for 300-500 employees in various roles and designations every month yearly. It sounds exhausting, right?

If the process doesn’t already seem tricky and elaborate enough, imagine it in an Indian context where the HR departments must also consider various state and national labour regulations and statutory requirements and abide by the same. Moreover, there can never be room for even a single error unless you wish to incur the wrath of employees, management, government bodies, or all at once. Therefore, some companies have specialised payroll sub-departments within their HR department or outsource the entire process to a third party to overcome any hassle.

This article tries to look into the nuances of Payroll and Statutory Compliance in the Indian context along with social security as to what they are, what an efficient process looks like, and what can be the best practices that can be followed while managing payrolls of employees in India.

Gross Income or salary is nothing but the total Cost-To-Company (CTC), barring deductions.

Gross Deduction is all regular or statutory deductions like PF, ESIC, IT, etc.

Constituents of Salary Structure in India

Let us elaborate upon the various components that constitute an important part of the salary structure of an Indian employee.

CTC: Cost-to-Company or CTC refers to the total amount a company spends on its employee. It is significantly higher than the employee receives, primarily because it is the total amount, including all the deductions such as PF, ESIC, IT, Gratuity, etc.

CTC = Gross Salary + Gratuity + PF + Prerequisites

Gross Salary: It is a total obtained by adding an employee’s basic salary plus allowances (before tax) and other deductions. It also includes overtime pay, joining/ quarterly/half-yearly/annual bonuses, holiday pay, etc.

Gross Salary = Basic Salary + HRA + Other Allowances

Net/Take-Home Salary: It is the amount calculated after deducting income tax at source (TDS) and other deductions per the company policy.

Net Salary = Gross Salary – Professional Tax – Public Provident Fund – Income Tax

Allowances: These refer to mandatory benefits provided to the employee as part of the organisation’s compliance with Indian laws. It may include House Rent Allowance (HRA), which depends on the work location’s nature, Medical Allowance, Leave Travel Allowance, Dearness Allowance, and so on.

Prerequisites: These comprise the non-cash benefits the company pays its employees at higher designations. For example, the use of company cars for work, rent-free accommodation or a personal accident policy. It forms a part of an employee’s salary, and they also pay taxes on them.

Deductions

In the context of Indian payroll, statutory deductions apply to the net CTC of an employee. These are compulsorily mandated by government laws and need to be adhered to. An employee gets a net take-home salary after necessary deductions are made from their current CTC.

These deductions majorly include:

Provident Fund (PF): A government-mandated deduction under the Employees Provident Fund & Miscellaneous Provisions Act, 1952, wherein a fixed amount is deducted from the employee’s monthly salary. This amount is added to their PF account and an equal contribution from the employer. It applies to all companies with a strength of 20 or more.

Employee State Insurance (ESI): It applies to employees whose gross salary is below INR 21,000 per month. It is the amount paid fully to an employee during medical leave, depending on the job profile and company policy.

Professional Tax: It is imposed on salaried employees and professionals.

The Payroll Cycle

In general, the payroll cycle comprises three stages for any organisation:

Pre-Payroll Activities: These consist of management-approved policies such as attendance policies, pay policies, leave policies, leave without pay policies, and so on. The employees must be aware of them firsthand. Salary structure data of each employee from respective departments are collected along with their eligible bonuses, allowances, and benefits.

Actual Payroll Process: After the pre-payroll activity is over, the payroll process is run before the month’s end. The data collected in the pre-payroll stage is validated against records in the HR department. Usually, the payroll software calculates the salaries after the appropriate data is fed into them.

Post-Payroll Activities: After all the calculations are done, and all the deductions such as PF, ESIC, and Professional Tax are made, the employees get their salaries credited by month end. It also includes the disbursal of payslips and preparing reports for upper management.

What are Statutory Compliance Requirements in India?

After covering the payroll system in India in-depth, we’ll now look at the statutory payroll rules created by state and national government bodies. Statutory compliances cover all the mandatory labour and taxation laws of the state or the central government. Businesses must completely comply with them to avoid fines or penalties. This usually comes under the combined ambit of the companies’ human resource management and legal departments.Major Statutory Laws in India are:

The Minimum Wages Act, 1948: A minimum wage is that below which a company cannot offer to its employees for the same work and at the same level. The state and national governments have established minimum wage rates for all occupations, sectors, or regions.

The Payment of Bonus Act, 1965: It defines the minimum and maximum cap on the annual bonus paid to the employees in specific organisations, subject to a minimum strength of 20 employees. The bonus payment calculations consider employee salary and the profits made by the establishments in a given financial year. Further, disqualifications under the Act are also defined.

Employees Provident Fund & Miscellaneous Provisions Act, 1952: Under this Act, an employer is responsible for creating a PF account for a newly joined employee with the government. Both the employee and the employer contribute equally to the fund monthly.

Employees State Insurance Act, 1948: The Act ensures that the employees are protected from any financial distress which may arise out of an employee’s sickness, disablement, or in worst cases, death during discharge of services on behalf of the employer.

The Maternity Benefits Act, 2017: Under this Act, every employed woman is entitled to a paid maternity benefit leave of up to 26 weeks for the first two children. It ensures the well-being of an employed, pregnant woman in an organisation with medical benefits.

The Payment of Gratuity Act, 1972: The Act aims to provide employees with a one-time gratuity at their retirement, provided the employee has remained in the organisation for a minimum of 5 years.

Summing Up

In summary, the payroll and statutory compliance systems are very elaborate and exhaustive for Indian companies. The entire exercise can be a huge energy drainer and easily take a toll on those closely related to the functioning of the process. Despite all odds, all organisations’ human resource management departments carry out the process monthly, without breaking a sweat, to ensure the correct and timely disbursal of an employee’s salary.

Frequently Asked Questions

1. What is statutory compliance in HR?

The legal framework that the HRs of an organisation must comply with to deal with its employees is known as statutory compliance in HR. The HR department must ensure that the employee policies adhere to statutory compliance and that employees are taken care of accordingly.

2. What is India's Payroll Compliance?

The policies developed by Indian authorities or the legal framework the companies must adhere to while providing salaries and generating payrolls in India come under India’s payroll compliance.

3. What do you mean by HR Compliance?

The process of aligning the HR policies of an organisation with the labour laws of the country and the world is called HR compliance.

4. Which elements does the Indian salary structure constitute?

The salary structure in India comprises CTC, Gross Salary, Net Salary, Allowances, and Prerequisites.

sumHR is the HR software in India that provides all services related to your human resource management needs under one roof. We provide unmatched HRMS, payroll, expense management, and talent acquisition services.