- HRMS Platform

A memorable HR journey, for employees to remember

- Customers

- Pricing

- Company

Menu

A memorable HR journey, for employees to remember

If you’ve got your things in order, you can run payroll literally in minutes. Our research shows that if you’ve got attendance, TDS decisions and variable payments in place, all you need is 5 clicks in our payroll software to generate those pretty payslips.

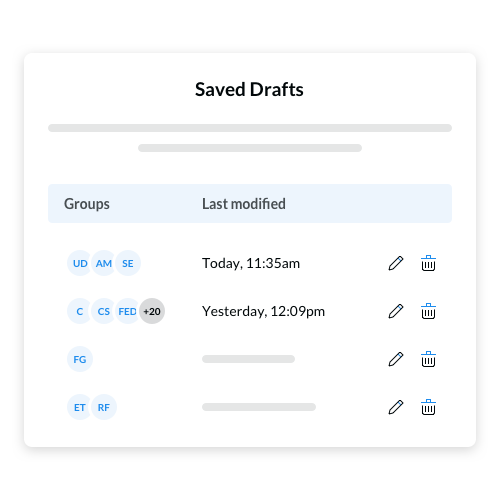

Got an urgent task or an important call to attendance while in the middle of a payroll run? Don’t throw away your adjustment efforts. Simply save your incomplete payroll run in drafts, and return to it when you’re ready.

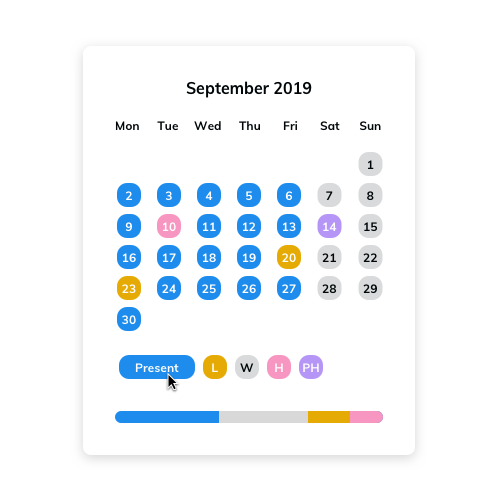

Lack of complete attendance data often becomes a roadblock in preparing for payroll processes, but not with sumHR. If you’re in a hurry and attendance doesn’t matter to your organization, skip it and achieve your payroll goals.

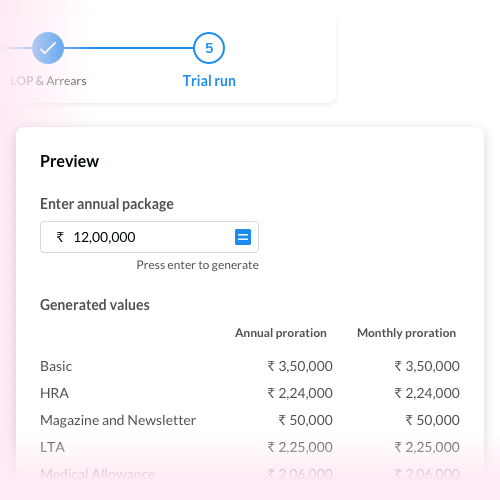

We know how nervous one can be on payroll day. To reduce your stress and improve your payroll performance, we’ve made special provisions in our payroll software to run payroll trials before the P-day. Test-drive your payroll process before you make the final run.

Handle special cases separately

Payroll processes often require skipping or holding back some employees from regular payroll runs. You can keep special cases aside (FnF or otherwise) and handle them via separate payroll runs, individually or even in bulk.

We make it effortless for you to deal with attrition payroll at scale. Process FnF (full and final) settlements in bulk, if you’ve got clear inputs in place. Go, complete your payroll goodbyes at speed and with a smile.

Don’t bother managers for minor bills and routine claims, let our automatic policy rules handle it for you. Settle frequent and low-risk expense claims with automatic approvals. Save time for managers, and improve employee satisfaction.

Process payroll before due-date

Are you an early-starter? If yes, this is just the right option for you. You can not only run payroll in advance (a few days before due date) but also skip pending/undecided unpaid leaves (LOPs) and carry them forward to next month’s payroll.

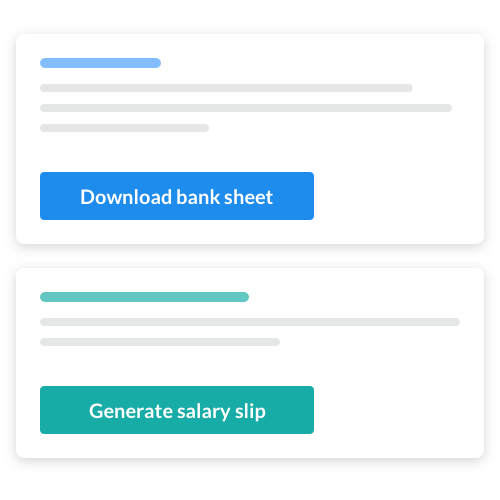

Sometimes, you may want to run payroll right up to the last step but not generate the payslips. Maybe to share data with your CA (chartered account) or it’s a company policy, perhaps. Whatever the reason, you can safely postpone salary generation.

Feel free to make last minute adjustments without fear or frustration. Bring on the ad hoc adjustments for extra payments/deductions, tax changes, LOP/arrear edits and more, without the stress. Do it in bulk or individually.

For the Marie Kondo in you, we’ve got multiple grouping options so that you can process payroll in batches. Go by departments, by locations, or even by employee types. This can be especially advantageous to managing cashflows and improving accuracy.

If you discovered a blunder or made an erroneous entry that ruined your payroll perfection, simply delete the payroll and we can all forget about it. If it’s only an error with a particular employee, you can delete specific salary slips too.

Forgot to add an employee into your payroll process on time and realized after having processed salary slips already? Relax, it’s no big deal. Run retrospective payroll for specific employees, past-dated calculations will be taken care of.

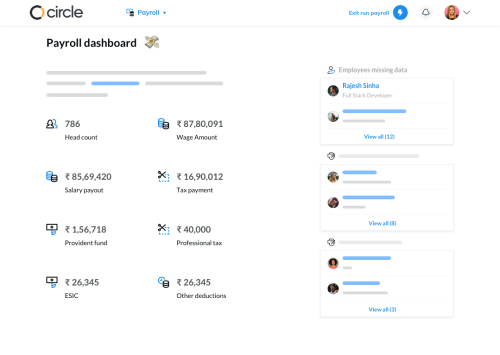

Get not just a bird’s eye view but a wholesome summary of your upcoming payroll. Gauge cashflow requirements or estimate tax liabilities well in advance so that you can run a swift and smooth payroll, like a boss!

Up next

Take your first step towards bringing happiness in your HR! Our customer team will guide you.