- HRMS Platform

A memorable HR journey, for employees to remember

- Customers

- Pricing

- Company

Menu

A memorable HR journey, for employees to remember

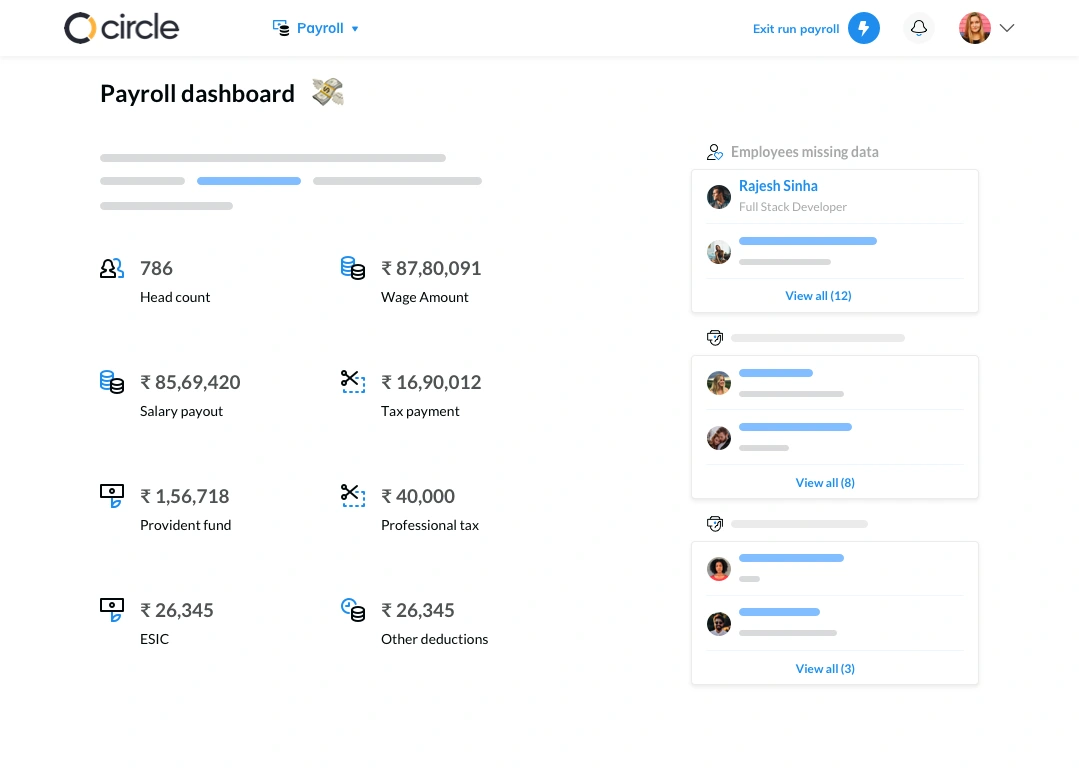

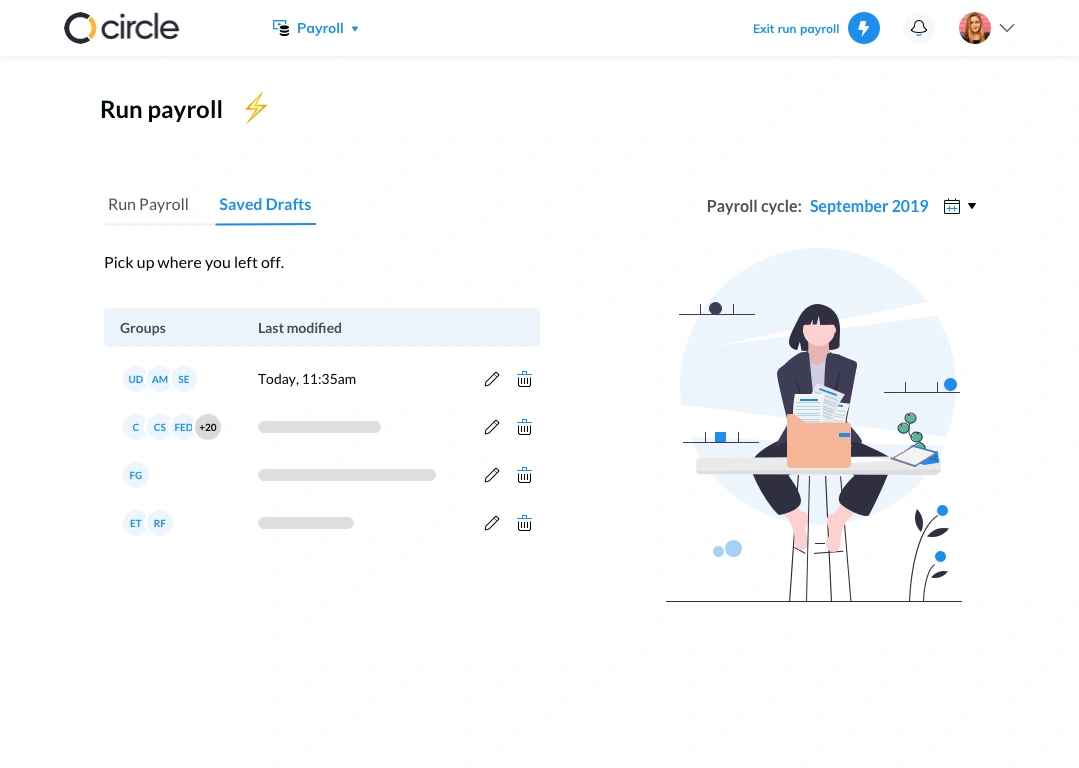

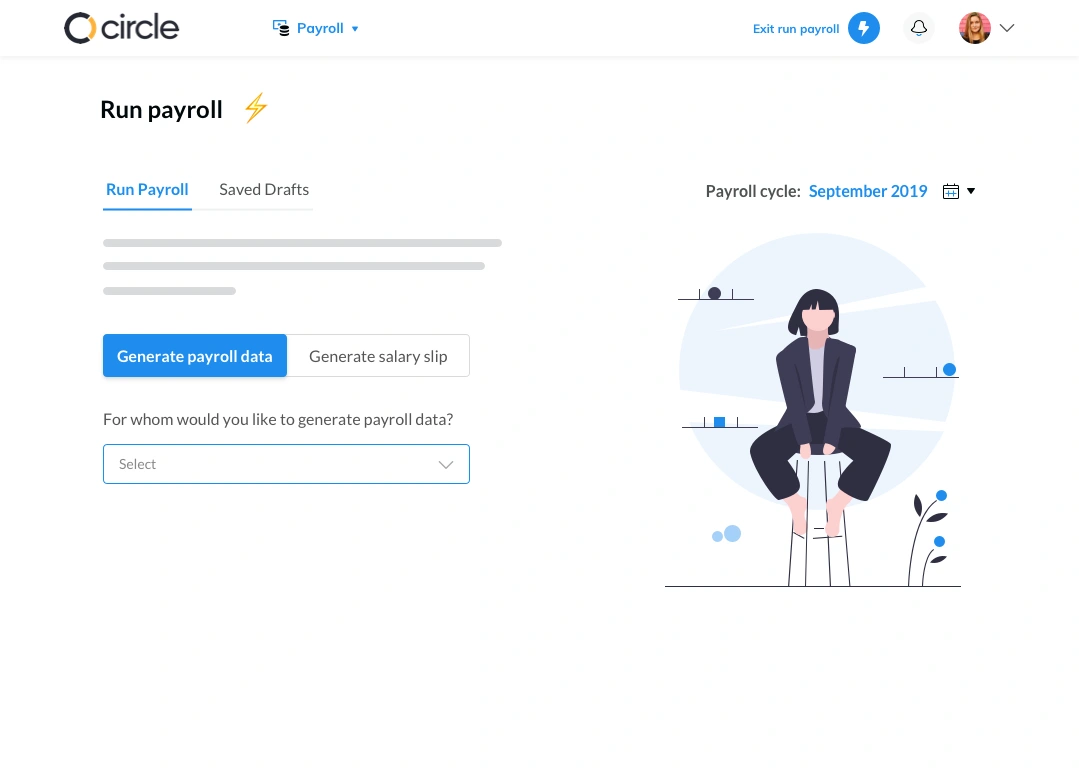

Get AAA rating for your payroll process: Automatic payroll calculations, accurate tax compliances & always on time. Our cloud-based free payroll software will reduce payroll chaos and deliver timely salary payments, for all sizes of business.

Complicated Indian payroll taxes can make even basic payroll activities difficult. All business owners want a reliable payroll team and the right payroll tools in their organizations, right? Using decades of payroll knowledge we have covered every aspect of payroll in our payroll software so that processing payroll takes minutes (not days) and you can pay employees on time! Automate your payroll processing with sumHR

Reduce your compliance risk and streamline your entire payroll cycle without the usual challenges in payroll. We’ll tackle complex payroll problems with accurate tax deductions so that you can avoid compliance penalties as your business scales. With sumHR’s Payroll Management Solution you can expect error-free payroll calculations and a stress-free payroll process.

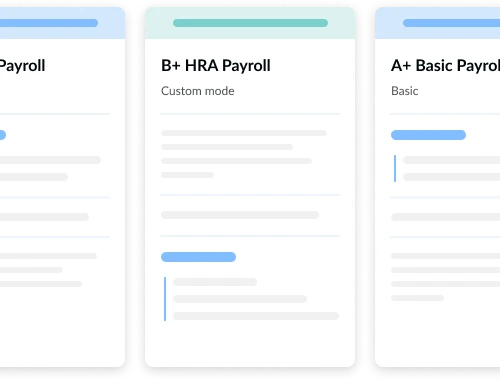

One of the most important payroll tasks is designing salary structures for all employees. The hallmark of our online payroll software is the flexibility to define unlimited income and deduction components making it as good as a custom payroll software for you. All size of businesses and business types have special payroll requirements and our adept free cloud-based payroll software in India can cater to every organization.

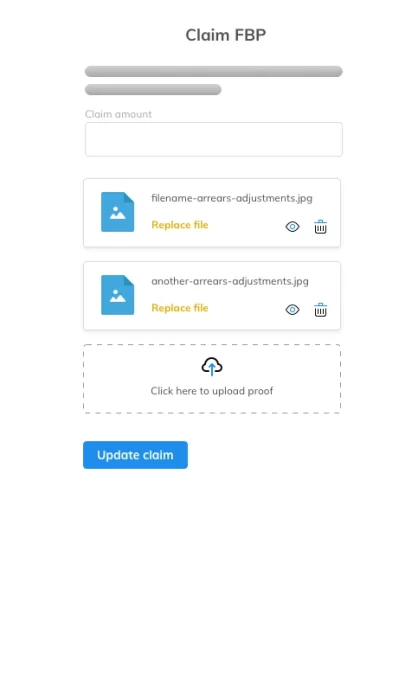

With employee self-service, empower them to declare or submit proofs of their tax-saving investments. Our online payroll solution reduces your payroll staff’s workload and improves employee’s payroll tax filings, making the payroll process pleasant for them as well!

Being present when employees need you the most can have a huge impact on businesses. Use sumHR’s free payroll software to manage loan/advance salary disbursement to manage Payroll payments and HR with our all in one HRMS.

Whether you’re driving performance with incentives, paying overtime after attendance tracking, or sharing happiness in the form of bonuses, our payroll software can handle a variety of extra payments with a payroll option in simple steps and take care of extra deductions (penalties, perhaps?) within a few clicks.

Even after 5 years, it's a wonderful experience using sumHR and our relationship continues to strengthen every year. It's a convenient, accurate and a cost effective HRM system, with reliable and prompt support.

Deepali Raut

Chowgule Construction Chemicals

Part ways with employees gracefully, without leaving any financial ambiguity. Avoid incorrect tax deductions at exit using our F&F settlement policies. Ensure complete clarity for uncomplicated exit payroll processing.

Payroll management for businesses of any size can be a mentally tiresome activity especially if the HR manager doesn’t have a payroll software solution. A list of companies has chosen us to take their payroll burden off so that they can focus on their people and while we process payroll and statutory filing for their businesses. The benefits of having salaries processed by experts far outweighs having a payroll department in-house.

If your employees travel a lot, we’ve got the right features to help you keep your organization’s money in check. Manage multi-currency costs for international business trips, and easily manage fuel or mileage conversions based on your company’s expense package.

Take your first step towards bringing happiness in your HR! Our customer team will guide you.