We are back with our quarterly feature-release announcement. This post is the first part of a two-part announcement, with this one focusing on the Payroll Software while the next one will be about the other aspects of our HR software.

We’ve had a productive summer with a long list of payroll upgrades keeping our team busy. Today, we are excited to share the progress we’ve made in strengthening your payroll module even further.

So, if you’re a payroll expert or want to learn more about our payroll software, dig in.

1. Payslips become more accessible.

Payslips are one piece of the HR puzzle that is very important to every employee.

Whether an employee is earning a lot or a little (relatively speaking), one will love to have easy access to their payslips whenever they need it.

Payslips no longer have to be printed, folded, inserted separately into envelopes, sealed and sent to employees via courier.

Now, every time you complete your payroll process with sumHR software, we will instantly send an email notification to every employee with a link to download their payslip.

What’s more, if your employees missed that email, they’ll also get a notification to download payslips from their mobile apps.

Here’s a sneak peek!What’s more, if your employees missed that email, they’ll also get a notification to download payslips from their mobile apps.

Here’s a sneak peek!

2. Comprehensive Annual Payslips, via Report Robo

More Payslip powers at your fingertips!

Paying wages is a significant part of a business owner’s expenses. And, keeping track of your year-to-date (YTD) payroll expenses is important for employers.

So, you can now instruct our Report Robo to send you YTD Annual Payslips (downloadable) every month for a group of employees, delivered right to your inbox.

Here’s an example of a YTD Annual Payslip below:

3. Bulk download of Form 16

As the tax filing date comes closer, your employees will flood you with requests for their Form16. But, worry now you can empower employees to download their Form16 from their own account and also hand it over personally.

Now you can download all Form16s of your company in one go. Just instruct your Report Robo to deliver it to your inbox, and sip some coffee while it arrives.

Here, is a small peep:

4. Selection for New / Old tax regime from mobile app

We make your payroll process pleasant by reducing your payroll staff’s workload and improving employee payroll tax filings.

As per new Income-Tax (IT) rules, employees have the choice to opt for the new tax regime in the current FY. If they choose to do so, their tax calculation brackets will be slightly more favourable (tax-saving), however, they will not get exemption for any tax-saving schemes except for 80ccd 2 (NPS).

We have enabled selecting this option from the mobile app itself, giving employees convenience to do so on-the-go.

Good, no? Here’s how you can do it:

5. Salary cycle with exclude weekly offs for mid-joinee while running payroll

Our Promise, to make your payroll easy!

We’ve made the salary calculation for mid-month joiners even more granular to benefit those organisations who have a very specific payroll policy about these situations.

In this case, if your organisation excludes weekly-offs when calculating the per-day value of an employee’s monthly payroll in case of employees joining in the middle of the month the salaries will be calculated after not only excluding the weekly-offs of the days when they worked but also those which went by before their joining date.

Confused? Here’s a formula to explain this:

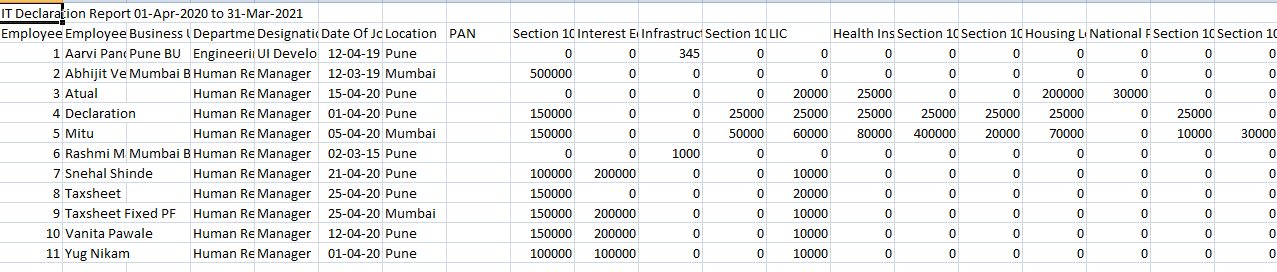

6. Comprehensive IT declaration & submission reports

We cover everything you need to handle Investment declaration for payroll.

As the title of this feature suggests, we now offer you the option to download a comprehensive report for the investment declarations made by your employees and the proof-submissions sent through by then in support of their declarations.

7. Non-payroll income & Non-salary income tax included in Form16

Generally, an HRMS provides Form16s for each employee based on the payroll that has been calculated through the Payroll Software itself.

With sumHR, now HR & payroll teams can add employee’s other non-payroll/non-salary income to include it in the Form16 itself. This can help the employee and also reduce chances of error when they’re filing for their income-tax.

Did you grab it, No? Here is a small tutorial for it then:

Full-pay salary component for components like Medical Insurance

You say it, We hear it!

Though it’s a rare practice and not commonly advisable by most payroll experts, some companies calculate full-month’s earnings/deductions for specific components in an employee’s payroll, irrespective of their actual paid-days (payable worked/employed days).

This normally applies to situations like mid-month new-joiners, LOP (loss of pay) or Arrears calculations, or mid-month exits. If your organisation is one such company, then we’ve got this fixed for you.

Here’s a snapshot!

Many payroll features often seem small but could have big underlying implications. A small change here could land a big impact there, especially when it comes to numbers & calculations. This time, we have an even longer list of developments than those mentioned above, we have only listed noteworthy ones in this post. We are confident that this new batch of upgrades will simplify your payroll process even more and bring greater flexibility in giving your employees a comprehensive payroll experience.

All for now! We would love to hear what you think about our new updates. Do drop your comments below and let us know what you think.