December is a month of festivities, vacations and winter holidays, right? Everyone calls or meets up with their favourite people, catching up on lost time and creating happy memories. Let me add some more excitement and reason for cheer with the news of our much awaited powerful features and swanky new modules for sumHR.

NEW MODULE: HR ANALYTICS

It’s been my dream to empower HR and management teams with data that’s not limited to boring numbers / MIS reports but data which is more comprehensive and analytical – helping them make informed decisions based on real insights. While it’s not a small project (to create an all-encompassing module) we can build right away, we’ve taken our first concrete steps in that direction with basic HR analytics of data from your Attendance, Leaves and Employee Database.

What to expect in HR Analytics?

Insightful HR Dashboards

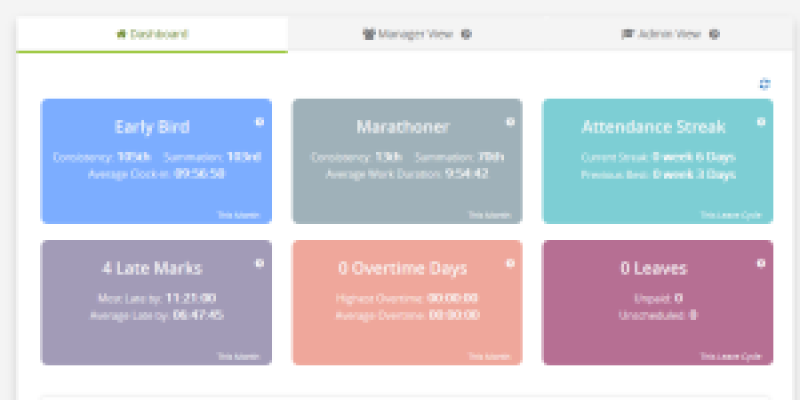

New HR dashboards for Employees, Managers and Administrators, whereby each user will see quick stats and interesting insights based on their role (as an employee/manager/admin) in the organization.

Employee Dashboard – Employees will see snapshots of their important Attendance and Leaves statistics, habits, trends, ranking, etc.

(Click the image to enlarge)

Manager Dashboard –

Managers will get an overview of their reportees’ Attendance and Leaves. The information displayed here will be focused on helping managers identify the performers, and encourage improvement from the ones lagging behind.

(Click image to enlarge)

Admin Dashboard

Administrators will have a birds-eye-view of basic HR activities on this page. There’s a section highlighting quick numbers about ‘Today’s Attendance’, and also upcoming joinees, confirmations, employees on notice and FnF, leave trends, etc.

(Click image to enlarge)

Personalized Analytics pages

Depending on roles, each user will have access to dedicated analytics pages which provide detailed stats with a graphic representation of their data. Understanding your HR data will never be boring again!

My Analytics

(Click image to enlarge)

Team Analytics

(Click image to enlarge)

Company Analytics

(Click image to enlarge)

Gamification of HR

Yes, while I’ve always found the word ‘gamification’ more of a jargon, I’m using it for the lack of a better word to explain how sumHR’s HR Analytics module can help companies create healthy competition within employees while simultaneously encouraging them to perform better.

Companies can choose to display analytics in 2 ways:(a) Ranking Method: This method will automatically assign ranks to each employee in different aspects of HR performance, depending on the data available in the system. These ranks will be visible to the employees across the company.(b) Self-Analysis: This method will portray all data without any ranking system. All employees will be shown their HR data in a manner which encourages improvement, highlighting their strong and weak points in their HR performance.

A TON OF PAYROLL FEATURE UPDATES

During the last couple of months, our technology team has burned a lot of calories trying to complete work on a long list of new features, enhancements and bugs in the Payroll module. Below, I’m highlighting some noteworthy new developments in the Payroll side of our software:

1. Preview Payslips

This option will help you preview a payslip before generating it, while trying to process payroll for an employee, individually. This way, you can ensure that the payslip which is dispatched to the employee is error-free.

2. VPF (Voluntary Provident Fund)

Though not a very common requirement, we did see a rise in demand for this recently and hence built it anyway. This feature will help you include extra PF contributions on behalf of the employee, over and above what’s already defined in your standard salary structure. Of course, it will be added only if the employee willingly requests the company to deduct extra/voluntary contribution in his/her name, to his/her own PF account.

3. Advance Tax

This feature is only applicable when an employee has a source of income other than his salary in your company, like capital gains on shares, interest on fixed deposits, etc., and the employee requests the company to deduct applicable tax amount (of the other income) from his salary itself, in the form of advance tax. If the amount paid as advance tax is higher than the tax liability from the employee’s Salary income, the employee will receive the excess amount as a refund in Form 16, which can be adjusted with other income tax liability at the time of filing returns (by the employee).

4. Bulk Upload/Import of LOP, Arrears, LWF, and Salary Slips

While you’re using the ‘Run Payroll’ process in sumHR, one of the steps provided an option to specify LOP, arrears and LWF for each employee individually. However, this could be quite cumbersome if you’ve got 100s/1000s of employees in the list. Hence, now you can upload a sheet with this data right in the middle of the ‘Run Payroll’ process itself! This will drastically reduce the time to finish your payroll process.

5. IT Declaration enhancement

Earlier, Section 10 of an employee’s IT Declaration page listed all fields which fall under Section 10. Though some of those fields were common, most of them were rarely used. So, now we’ve added a smart check which will display only those fields (in Section 10) which are being used in your company’s salary structures. This reduces the unnecessary clutter for you and your employees.

6. EDLI (Employee’s Deposit Linked Insurance) updates

Recently the government has increased the EDLI limit from INR 6500 to INR 15000. While some companies may wish to continue with the old limit, several have changed over to INR 15000 limit and upgraded their PF calculations accordingly. For those of you who wish to accommodate this change, sumHR is ready to incorporate the new limit for your PF calculations.

7. Gross CTC with complicated Salary Structure formats

The gross CTC option is specially provided to those employers who don’t use a “Standard Salary Structure” or companies which adopt a highly customized format of CTC components per employee, on a case-to-case basis.

For example: If Telephone reimbursement component is included in the CTC with a limit of 15000, but the applicability is decided by an employee (him/herself) then there may be chances that each employee will end up getting a different amount in Telephone reimbursements, like INR 12500, 11700, 7000, etc. Though there was a possibility to accommodate in sumHR so far, it was a very long and cumbersome process, hence we’ve never offered any support on this front.

Now we’ve built an option within our system which can easily accommodate such complicated salary structures through an easy workaround. This is an on-demand option available to companies which specifically request it – so if you’d like to implement such salary structures with the Gross CTC format, please send in your request to support@sumhr.com

8. New Reports and Enhancements to Existing Reports

In addition to the enhancements to our Loan, Advance and Deduction features, we’ve created 3 new reports under the Payroll category:

a. Loan report

b. Advance and deduction reports. Repayment of loan, advance and deduction reportAll payroll reports will now bear the 3 constant pieces of info: employee number/code and email ID also

9. ECR (Electronic Challan cum Return) format of PF report

This is a much-needed report which most companies requested for. It will help companies verify the data of employees’ PF calculations before uploading the same to the govt. system for online PF return filing.

10. Enhancements to the ‘Run Payroll’ process

In Step 1 (mentioned above), when you begin your payroll process our system runs a check to verify all existing data and displays errors/action-items which need to be corrected. However, it took a little longer than one would like to clear these errors. Now, we’ve added a nifty enhancement which will display all errors/action-items with hyperlinks to necessary pages. We’ve also improved and enhanced the Payroll Dashboard experience by revamping the layout, made it more user-friendly, and also simplified the information to help experts/non-experts get what they want, faster and easier.

11. Employer PF inclusion/exclusion from Employee CTC

Earlier, our system would by default include the employer’s contribution of PF within the employee’s CTC itself. However, we heard your feedback and requests for an option to exclude the Employer’s contribution from the CTC and yet track it within the salary slips – so that’s what we built for you! You can find this option on the Extra Settings page.

12. Non-taxable Extra Payments

We have added a new category in Extra Payments feature, called as Gratuity. Along with this, we’ve also included an option to choose whether the Extra Payment is taxable or tax-free, in some categories of Extra Payments like Gratuity, Leave encashment, and ‘Others’.

We’re hoping these new launches will help end your 2015 on a high note because we’re all super excited about them already. What’s more, we’ve got plans to start your new year on a high note as well, with the upcoming new module of HR Letters, which is slated to go live in the 2nd week of January 2016 itself!

So, from all of us here at sumHR, here’s wishing you all a rocking New Year’s Eve and 2016 filled with a lot of action and amazement 🙂

New module: HR Analytics

It’s been my dream to empower HR and management teams with data that’s not limited to boring numbers / MIS reports but data which is more comprehensive and analytical – helping them take informed decisions based on real insights. While it’s not a small project (to create an all-encompassing module) we can build right away, we’ve taken our first concrete steps in that direction with basic HR analytics of data from your Attendance, Leaves and Employee Database.

What to expect in HR Analytics?

Insightful HR Dashboards

New HR dashboards for Employees, Managers and Administrators, whereby each user will see quick stats and interesting insights based on their role (as an employee/manager/admin) in the organization.

Employee Dashboard – Employees will see snapshots of their important Attendance and Leaves statistics, habits, trends, ranking, etc.

(Click image to enlarge)

Manager Dashboard

Managers will get an overview of their reportees’ Attendance and Leaves. The information displayed here will be focused on helping managers identify the performers, and encourage improvement from the ones lagging behind.

(Click image to enlarge)

Admin Dashboard

Administrators will have a birds-eye-view of basic HR activities on this page. There’s a section highlighting quick numbers about ‘Today’s Attendance’, and also upcoming joinees, confirmations, employees on notice and FnF, leave trends, etc.

(Click image to enlarge)

Personalized Analytics pages

Depending on roles, each user will have access to dedicated analytics pages which provide detailed stats with graphic representation of their data. Understanding your HR data will never be boring again!

My Analytics

(Click image to enlarge)

Team Analytics

(Click image to enlarge)

Company Analytics

(Click image to enlarge)

Gamification of HR

Yes, while I’ve always found the word ‘gamification’ more of a jargon, I’m using it for the lack of a better word to explain how sumHR’s HR Analytics module can help companies create a healthy competition within employees while simultaneously encouraging them to perform better.

Companies can choose to display analytics in 2 ways:(a) Ranking Method: This method will automatically assign ranks to each employee in different aspects of HR performance, depending on the data available in the system. These ranks will be visible to the employees across the company.(b) Self-Analysis: This method will portray all data without any ranking system. All employees will be shown their HR data in a manner which encourages improvement, highlighting their strong and weak points in their HR performance.

A ton of Payroll feature updates

During the last couple of months, our technology team has burned a lot of calories trying to complete work on a long list of new features, enhancements and bugs in the Payroll module. Below, I’m highlighting some noteworthy new developments in the Payroll side of our software:

1. Preview Payslips

This option will help you preview a payslip before generating it, while trying to process payroll for an employee, individually. This way, you can ensure that the payslip which is dispatched to the employee is error free.

2. VPF (Voluntary Provident Fund)

Though not a very common requirement, we did see a rise in demand for this recently and hence built it anyway. This feature will help you include extra PF contributions on behalf of the employee, over and above what’s already defined in your standard salary structure. Of course, it will be added only if the employee willingly requests the company to deduct extra/voluntary contribution in his/her name, to his/her own PF account.

3. Advance Tax

This feature is only applicable when an employee has a source of income other than his salary in your company, like capital gains on shares, interest on fixed deposits, etc., and the employee requests the company to deduct applicable tax amount (of the other income) from his salary itself, in the form of advance tax.

If the amount paid as advance tax is higher than the tax liability from the employee’s Salary income, the employee will receive the excess amount as a refund in Form 16, which can be adjusted with other income tax liability at the time of filing returns (by employee).

4. Bulk upload/Import of LOP,Arrears, LWF,Salary Slips

While you’re using the ‘Run Payroll’ process in sumHR, one of the steps provided an option to specify LOP, arrears and LWF for each employee individually. However, this could be quite cumbersome if you’ve got 100s/1000s of employees in the list. Hence, now you can upload a sheet with this data right in the middle of the ‘Run Payroll’ process itself! This will drastically reduce the time to finish your payroll process.

5. IT Declaration Enhancement

Earlier, the Section 10 of an employee’s IT Declaration page listed all fields which fall under Section 10. Though some of those fields were common, most of them were rarely used. So, now we’ve added a smart check which will display only those fields (in Section 10) which are being used in your company’s salary structures. This reduces the unnecessary clutter for you and your employees.

6. EDLI ( Employee's Deposit Linked Insurance) Updates

Recently the government has increased the EDLI limit from INR 6500 to INR 15000. While some companies may wish to continue with the old limit, several have changed over to INR 15000 limit and upgraded their PF calculations accordingly. For those of you who wish to accommodate this change, sumHR is ready to incorporate the new limit for your PF calculations.

7. Gross CTC with complicated salary structure formats

Gross CTC option is specially provided to those employers who don’t use a “Standard Salary Structure” or companies which adopt a highly customized format of CTC components per employee, on case-to-case basis.

For example: If Telephone reimbursement component is included in the CTC with a limit of 15000, but the applicability is decided by an employee (him/herself) then there may be chances that each employee will end up getting a different amount in Telephone reimbursements, like INR 12500, 11700, 7000, etc. Though there was a possibility to accommodate in sumHR so far, it was a very long and cumbersome process, hence we’ve never offered any support on this front.

Now we’ve built an option within our system which can easily accommodate such complicated salary structures through an easy workaround. This is an on-demand option available to companies which specifically request for it – so if you’d like to implement such salary structures with the Gross CTC format, please send in your request to support@sumhr.com

8. New reports and enhancements to existing reports

In addition to the enhancements to our Loan, Advance and Deduction features, we’ve created 3 new reports under the Payroll category:

a. Loan report

b. Advance and deduction reportc. Repayment of loan, advance and deduction reportAll payroll reports will now bear the 3 constant pieces of info: employee number/code and email ID also

9. ECR (Electronic Challan Cum Return)format of PF Report

This is a much-needed report which most companies requested for. It will help companies verify the data of employees’ PF calculations before uploading the same to the govt. system for online PF return filing.

10. Enhancements to the run payroll processes

In Step 1 (mentioned above), when you begin your payroll process our system runs a check to verify all existing data and displays errors/action-items which need to be corrected. However, it took a little longer than one would like to clear these errors. Now, we’ve added a nifty enhancement which will display all errors/action-items with hyperlinks to necessary pages.

We’ve also improved and enhanced the Payroll Dashboard experience by revamping the layout, made it more user-friendly, and also simplified the information to help experts/non-experts get what they want, faster and easier.

11. Employer PF inclusions/exclusion from employee CTC

Earlier, our system would by default include the employer’s contribution of PF within the employee’s CTC itself. However, we heard your feedback and requests for an option to exclude the Employer’s contribution from the CTC and yet track it within the salary slips – so that’s what we built for you! You can find this option on the Extra Settings page.

12. Non-taxable extra payments

We have added a new category in Extra Payments feature, called as Gratuity. Along with this, we’ve also included an option to choose whether the Extra Payment is taxable or tax-free, in some categories of Extra Payments like Gratuity, Leave encashment, and ‘Others’.

We’re hoping these new launches will help end your 2015 on a high note because we’re all super excited about them already. What’s more, we’ve got plans to start your new year on a high note as well, with the upcoming new module of HR Letters, which is slated to go live in the 2nd week of January 2016 itself!

So, from all of us here at sumHR, here’s wishing you all a rocking New Year’s Eve and 2016 filled with a lot of action and amazement 🙂